What you need to know about infrastructure

Is there really a crisis in public-sector infrastructure?

The outside girders of the Champlain bridge have been badly damaged by decades of poor drainage. (Photo by Roger Lemoyne)

Share

I’m hearing a lot about infrastructure this weekend. Justin Trudeau’s video on Tuesday noted that thanks to the relatively healthy state of its finances, “the federal government has room to invest.” On Thursday, Larry Summers cited deteriorating infrastructure as an exacerbating factor for his diagnosis of ‘secular stagnation’ in the US economy. An infrastructure proposal will be debated tomorrow. I don’t think the talk about infrastructure will end there, so it’s probably a good idea to review the theory and some data.

One of the core functions of government is to provide public goods, and many of these—roads, for example—take the form of physical assets. Economies cannot function without a minimal amount of infrastructure in place, and good choices will increase productivity and incomes. On the other hand, it’s very easy for governments to make poor choices. For example, not every public infrastructure program actually provides public goods; sometimes it simply (badly) duplicates a project that the private sector would have undertaken anyway. Nor is it the case that every public infrastructure program always generates enough benefits to offset its costs.

Governments that are preoccupied with deficits will always be tempted to cut back on spending to build new infrastructure, or even to cut back on the spending required to maintain the infrastructure that’s already in place. So one of the effects of the years of deficits was a sharp reduction in the growth of the stock of publicly-owned assets.

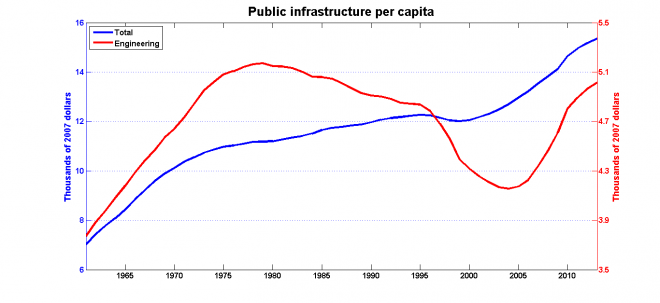

But things have changed over the past decade. The data used in the chart below are taken from the estimates for the public-sector capital stock in Cansim Table 031-0002 (this also includes things like hospitals and schools). I’ve also broken out the numbers for engineering: roads, bridges and the like. It’s important to remember that these are estimates for the stock of capital in place, not the flow of investment in a given year. Here they are, expressed in per capita terms:

The years of deficits—and especially the years of deficit-cutting—had the sort of effect you might expect. But it also looks as though governments have already begun rebuilding the stock of public capital—and the turning point occurred well before the 2009-11 stimulus program.

Warnings about a crisis in public-sector infrastructure are not new. What is new over the past decade is that governments have been doing something about it.