euro crisis

How austerity in Greece is threatening the euro zone again

A coalition of radical leftist parties seem poised to take power in Greece. Could the troubled country really leave the euro zone?

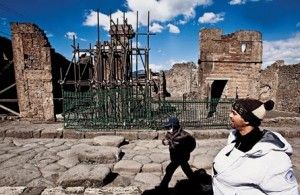

Things fall apart in Italy, and not just the economy

Ancient architectural ruins are crumbling faster than ever due to austerity measures

Has Greece run out of time and money?

Germany and the International Monetary Fund both plan to cut off Greece as it seeks another $60 billion to avoid certain bankruptcy, reports Spiegel Online. Greece is struggling to meet the conditions of its $157 billion bailout from last March—efforts to trim its massive deficit and boost taxes were complicated by two national elections this spring. Germany appears to have run out of patience (and political capital) when it comes to backing-up Greece, with one government minister stating, “If Greece no longer meets its requirements there can be no further payments …For me, a Greek exit has long since lost its horrors.” A decision by the IMF to pull the plug on Greece would be more worrisome, and likely mean default for the country would happen much sooner (a matter of weeks) than later.

Germany tells Greece to stop asking for help

Help yourselves, German Finance Minister Wolfgang Schaeuble told Greece today in the pages of Bild am Sonntag.

Ireland holds referendum on EU fiscal compact

Ireland is voting on whether to ratify the EU’s fiscal compact that sets strict limits on budget deficits for member nations. If rejected, the debt-beleaguered country will be denied further bailout money after its current tranche runs out in 2013.

Bond auctions calm euro zone fears after Dutch government collapse

Better-than-expected government bond auctions in Europe are providing some comfort to those worried about a resurgent euro zone debt crisis after the Dutch government collapsed in the face of austerity talks this week.

Moody’s downgrade of six EU countries goes unnoticed

In normal circumstances, if a major credit rating firm like Moody’s downgraded six European Union countries in a row, that would likely set markets tumblings all over the world. That would be especially true if notice of the downgrades included warnings about top-rated Britain, France and Austria. But that is not what’s happening just one day after Moody’s adjusted the sovereign debt ratings of Italy, Portugal, Spain, Malta, Slovenia and Slovakia downward, and warned that it could remove the triple-A rating from the UK, France and Austria soon. The Moody’s downgrade on Monday night did not shake markets that were otherwise buoyed by news that Greek lawmakers had approved a package of austerity measures, paving the way for a $172 billion (U.S.) bailout.

EU leaders aim for ‘fiscal compact’

German oversight proposal irks Greece

Merkel under siege

Angry voters at home are increasingly turning against her and her coalition government

Merkel hopes to ease investor worries over Euro debt crisis

U.S. urges political action to raise market confidence in Europe

Room among the ruins

Downturn: The euro crisis hits tourism