Intro to productivity (that thing Canadians are apparently so bad at)

Presenting: the Econowatch special report on productivity

Share

If you spend any time reading about the Canadian economy, you have inevitably come across the Great Canadian Productivity Puzzle. Canada’s productivity is much lower than that of other countries, and we don’t really know why. Neither do we seem to be able to fix the problem. Policymakers have used every trick in the book to try to boost productivity, but the results have disappointed. Productivity growth matters because it drives up our purchasing power: if it lags, so will our standard of living. And yet—here’s where things get interesting—Canadians are far better off than one would tell looking at our dismal productivity performance over the past 20 years. How did we do it? In this six-part special report, Maclean’s in-house economist Stephen Gordon investigates the mystery. (With a contribution from Econowatch editor Erica Alini.)

Click here to see what’s coming up next.

Here’s what economists mean by productivity—and why you should care

The goal of boosting productivity is to increase households’ purchasing power. In a closed economy—one that does not engage in international trade—the only way to increase domestic income is to increase domestic production. Consumers cannot buy something that hasn’t been made. (The link between income and output is more nuanced in an open economy, but I’ll get to that in a subsequent post.)

Now suppose the population of said economy is growing: The only way for people to become better off is to find a way to increase production by a rate greater than population growth. In other words, per capita incomes can grow only if productivity grows.

There are different types of productivity. There’s labour productivity, which is output divided by the total number of hours worked—that is, the sum of the hours worked by all employees, which gives us the amount produced in 60 minutes by a hypothetical average employee. There’s capital productivity, which is output divided by the amount of capital held (machines, office buildings, infrastructure). And then there is multifactor productivity, a trickier but very important statistic, which tries to capture increases in output that cannot be explained by increases in either labour or capital. The simplest way to measure and understand productivity is labour productivity, so, for now, let’s concentrate on that.

A couple of myths worth busting

The emphasis on productivity has been known to lead to some confusion. For example, some may view a productivity growth agenda as a thinly-disguised plot to oblige employees to work harder and for longer hours. But improving productivity is not about forcing a construction worker to dig faster and to work through his lunch break, it’s about providing him with a mechanical excavator and the skills to use it. Productivity growth is about being able to create more value with the same amount of effort.

Another popular misconception is that increased productivity means higher unemployment. If the same amount of output can be produced by fewer people, then what happens to those excess workers? This is the “lump of labour” argument, the notion that the quantity of work to be done is a fixed constant. It is also a well-known fallacy: higher productivity increases the demand for labour, because more productive workers are more valuable to employers. Although higher productivity in a given industry may reduce employment in that sector, the increase in total output and income across the economy will create new, better-paying, employment opportunities elsewhere.

How productivity growth drives up wages

From a firm’s perspective, a more productive worker is a more profitable one. For a given number of workers, increased productivity means increased output, sales and revenues. If wages and other costs of production don’t adjust, increased revenues are increased profits.

But the story doesn’t stop here. Since the profits generated by each worker have increased, firms will conclude that the way to keep boosting profits is to hire more workers. In turn, the competitive pressures generated by the increased demand for labour will bid up wages, to the point where the extra revenues generated by hiring an additional worker are completely offset by the higher wages that this worker can command.

Another channel by which greater productivity could lead to higher purchasing power is through prices. More productive workers produce more output, and this increase in supply may drive down the price of the good or service being produced. Either way, real wages—that is, wages divided by the price of goods and services—will rise. The adjustment can be an increase in the numerator (wages), a decrease in the denominator (prices), or some combination of the two.

(Wonkish detail: Labour productivity measures average productivity, but the mechanism described in the preceding paragraphs predicts that real wages should track marginal productivity—the extra output produced by an additional unit of labour. It turns out that although average and marginal productivity are different concepts, real wages track average labour productivity measures reasonably well. The reason why the Cobb-Douglas functional form is so popular in applied work is its property according to which marginal productivity is equal to average productivity.)

Canada vs. Uncle Sam

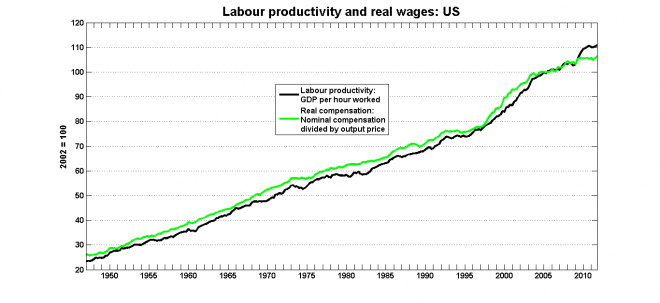

What ensures that wages respond to labour productivity in the way I described are market forces. In a competitive labour market, the increase in the demand for labour produces upward pressure on wages, and an increase in output supplied to a competitive goods market will drive down prices. That’s what you see in the U.S.:

Canada’s history of protectionism, on the other hand (in addition to restrictions on trade between provinces), has resulted in markets that are generally less competitive than those in the large U.S. market and real wages that do not track productivity growth as closely:

Canada’s history of protectionism, on the other hand (in addition to restrictions on trade between provinces), has resulted in markets that are generally less competitive than those in the large U.S. market and real wages that do not track productivity growth as closely:

P.S. See the lag between productivity and wages in the upper-right corner of the U.S. chart? For the past few years, productivity rose but real wages didn’t quite follow. The fact that U.S. labour markets have been deeply depressed since the financial crisis likely goes a long way in explaining why.

P.S. See the lag between productivity and wages in the upper-right corner of the U.S. chart? For the past few years, productivity rose but real wages didn’t quite follow. The fact that U.S. labour markets have been deeply depressed since the financial crisis likely goes a long way in explaining why.

The takeaways:

What do economists mean by productivity? There are many definitions, but all measures of productivity try to capture the ability to produce more output—which is the same thing as generating more income— with the same levels of inputs.

Why do economists think productivity is a big deal? Increases in productivity are inextricably linked to increases in incomes and wages. Real, per capita income growth can only be sustained by increases in productivity.

****

- Part one: Intro to productivity (that thing Canadians are apparently so bad at)