A little context on the decline of manufacturing employment in Canada

Stephen Gordon looks at the numbers—and zooms out

Share

The debate over “Dutch Disease” tends to focus almost entirely on what happened in Canada between the oil price surge in 2002 and the onset of the recession in 2008. Employment in the manufacturing sector fell by more than 300,000 during this period, but this number is almost never put into context.

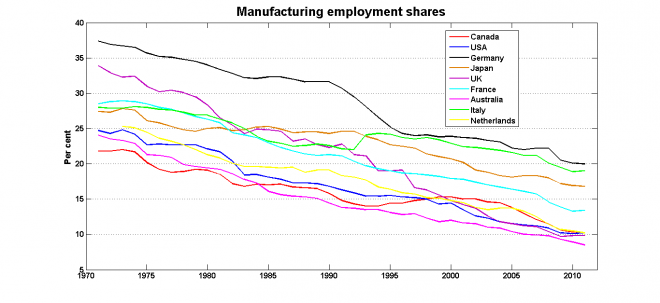

Firstly, the share of people employed in manufacturing has been on a secular decline in industrialized countries for at least the last forty years:

It’s worth pointing out that this trend was established several decades before Chinese manufactures appeared on world markets.

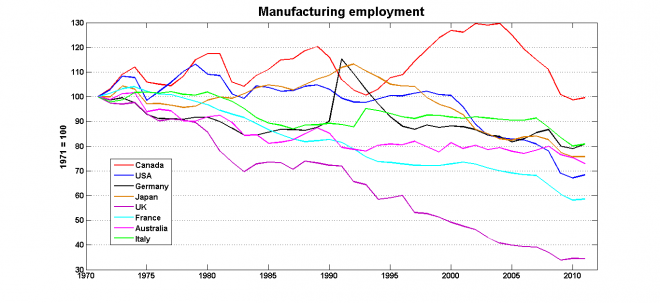

Here are manufacturing employment levels, scaled so that all countries are equal to 100 in 1971 :

Canada is the only country in these graphs where manufacturing sector employment is still on par with what it was forty years ago in absolute terms. (The bump you see in the Canadian data from, roughly, 1995 to the late 2000s will be the subject of an upcoming post.)

The most important thing to note is that the manufacturing employment cycle has been going on for decades. We’ve seen this before, and we’ll doubtlessly see it again.

Update: Data source is the FRED data base at the St Louis Federal Reserve.