The longer Stephen Harper is Prime Minister… the longer taxes will stay low

Stephen Gordon updates a telling chart

Share

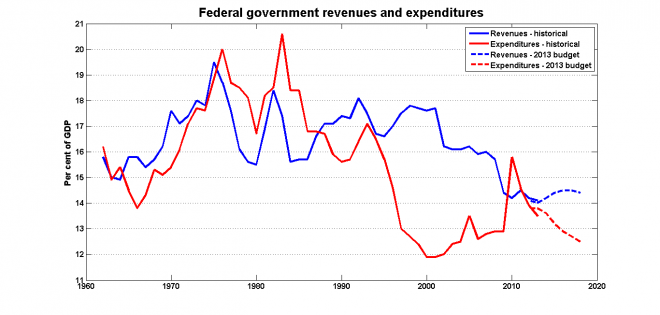

The federal Department of Finance has chosen to mark the publication of Paul Wells’ new book The Longer I’m Prime Minister by updating the data that form the basis of one of the themes of the book (or so I’m given to understand; my copy is on its way). The Fiscal Reference Tables now include the fiscal year 2012-13, and the numbers confirm a trend of a federal government whose revenues and expenditures have reached — and have since been kept at — historic lows:

As I’ve written before, the Conservatives have applied the “starve the beast strategy“: First, cut taxes; second, cut spending in order to match lower revenues; third, obtain a balanced-budget for a smaller government. As the red line in the chart shows, the Harper government was temporarily thrown off this past by the financial crisis, which required emergency stimulus spending. They are, however, back on track.

As I’ve written before, the Conservatives have applied the “starve the beast strategy“: First, cut taxes; second, cut spending in order to match lower revenues; third, obtain a balanced-budget for a smaller government. As the red line in the chart shows, the Harper government was temporarily thrown off this past by the financial crisis, which required emergency stimulus spending. They are, however, back on track.

Before Stephen Harper became prime minister, federal government revenues had stayed above 15 per cent of GDP for at least forty years. They have now remained below that 15 per cent historical threshold for five years in a row, and are expected to stay that low until at least the next election. And as each year passes, Canadians will get more and more used to the idea of a government with taxes lower than Diefenbaker’s.