Canada’s job market is firing on all cylinders

Econ-o-metric: Why are so many Canadians who’ve reached retirement age still working? And what does a hot labour market mean for interest rates?

A bridge is seen under construction in Toronto, March 10, 2014. (Aaron Harris/Reuters)

Share

Canada’s economy may have reached peak velocity.

Employment was little changed in September from August, as employers added 112,000 full-time workers, offsetting a decline of similar magnitude in part-time work, Statistics Canada reported on Oct. 5.

The unemployment rate was unchanged at 6.2 per cent, the lowest since the autumn of 2008.

Why the latest hiring data matters

The Bank of Canada was surprised by the economy’s strength this year. It is now paying extra attention to key indicators, such as the monthly jobs survey, for clues as to whether these extraordinarily good times will continue. If the central bank decides the first-half growth rate was for real, it will keep raising interest rates to stay ahead of inflation.

READ MORE: If the economy is so great, why do we feel so bad?

The trend

An unemployment rate of 6.2 per cent is very low by historical standards, as it has dropped below six per cent only a handful of times. Canada’s economy still has momentum, but it slowed in the third quarter, judging by the latest hiring data. Employers added 42,000 jobs between July and September, a 0.2 per cent rate of growth. That was slower than 0.6 per cent in second quarter and 0.5 per cent over the first three months of 2017.

Glass half full

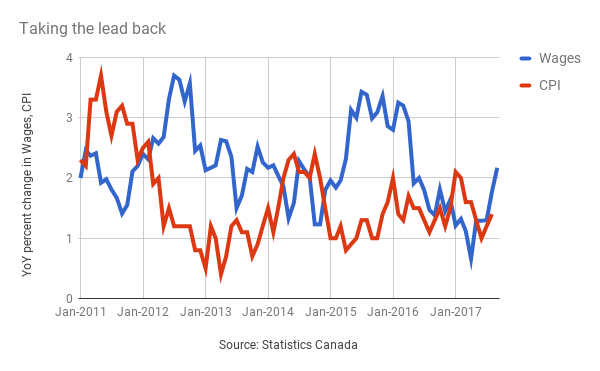

A swap of about 100,000 part-time jobs for an equal number of full-time jobs is a good trade. But the big positive in the latest jobs numbers was a notable jump in wages. For the first time in about a year, paycheques are growing faster than inflation.

Glass half empty

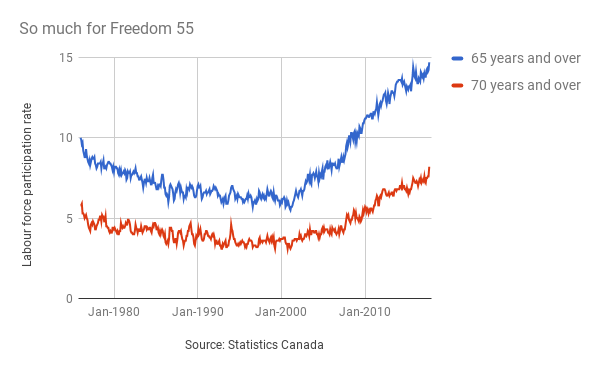

The monthly jobs data provide a snapshot of trends that take much longer to solidify. More than 842,000 Canadians aged 65 and older were employed in September, the most ever. This is mostly demographics: the population is aging, so you would expect a greater number of older people in the workforce. But it does suggest a significant number of people are reaching retirement age without enough income to live comfortably without a regular salary.

Bottom line

On the whole, Canada’s labour market remained strong in September. The shift to full-time from part-time brought an increase in hours worked, which means more economic output and fatter paycheques. The jump in wages from a year earlier is especially significant, as Bank of Canada Governor Stephen Poloz singled out that number last month as something he would be watching especially closely. The central bank is likely due for a pause after raising interest rates twice this summer, but the strength of the labour market will keep Bay Street talking about a third increase before the year is out.

MORE ABOUT THE ECONOMY:

- America is making country of origin rules a NAFTA priority. Look out, Canada.

- Dominic Barton wants Justin Trudeau to think big about the economy. Will he?

- Canada’s economy surges in second quarter

- An interview with Justin Trudeau

- Econo-metrics: The (almost) monster first quarter GDP

- Canada’s unemployment rate falls to 6.5 per cent

- Opening shot coming in fifth Canada-U.S. softwood lumber war

- Canada posts surprise trade deficit in February