It’s ridiculous to call a carbon tax a sales tax. Here’s why.

A carbon tax is no more a sales tax than income taxes are, writes University of Calgary economist Trevor Tombe

Alberta Premier Rachel Notley speaks with media about the wildfires in Fort McMurray, Alta., on Wednesday May 4, 2016. The wildfire has already torched 1,600 structures in the evacuated oil hub of Fort McMurray and is poised to renew its attack in another day of scorching heat and strong winds.THE CANADIAN PRESS/Jason Franson

Share

Is a carbon tax a PST in disguise?

It’s a question on the minds of many Albertans, and embraced by certain political leaders and public commentators. To take just two notable examples, Brian Jean, leader of Alberta’s Wildrose Party opposition, called it a “back-door PST” and Michelle Rempel, a prominent Federal politician from Alberta, recently made the same comparison.

This isn’t mere semantics. Words matter. Thoughts matter. How we communicate and debate matters. This question matters.

So are they correct? Is a carbon tax a PST? No. The two taxes have different effects, different objectives, are levied on very different things, and have different legal implications. In short, a carbon tax is no more a sales tax than income taxes are.

Before diving in, let’s put aside the issue of whether a carbon tax is good or bad. That’s a separate conversation. Even if you’re not convinced by the arguments in favor of carbon pricing, a carbon tax is not a PST in disguise. It is entirely possible to oppose a carbon tax on reasonable and rational grounds. Acknowledging that a carbon tax isn’t a PST is in no way support for a carbon tax, but it is support for clear and honest debate. Something I hope most of us favour.

So, let’s get started.

Different Effects

A common argument is that the prices of the goods and services we buy will rise. Thus, a carbon tax is a PST.

That prices will rise is undeniable, but doesn’t itself make a carbon tax a sales tax. The two taxes have very different effects on the cost of things we buy.

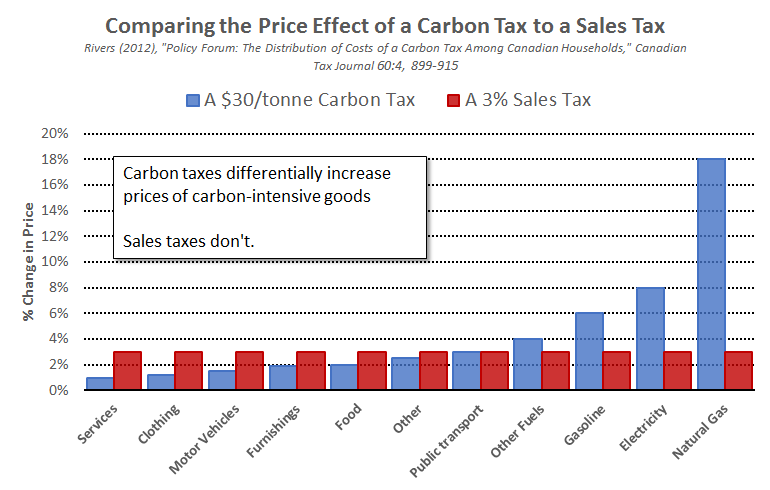

A sales tax typically falls on the vast majority of goods and services out there. (Though some goods are exempt.) A carbon tax, on the other hand, is a tax on only carbon. Goods that are more carbon-intensive will experience a larger price increase than goods that are less carbon-intensive. Recent research from the University of Ottawa’s Nic Rivers crunches the numbers for Canada. I plot his results below, and compare them to the stylized effect of a sales tax.

Notice sales taxes increase the price of everything the same way. You pay 5 per cent GST on a new computer. You pay 5 per cent on a haircut. You pay 5 per cent on gasoline when you fill up at the pump. And so on. A carbon tax, however, increases the price of gasoline (a carbon-intensive good) much more than haircuts.

Different Objectives

The purpose of the taxes also differ. One is primarily to raise revenue, while the other is attempting to change behaviour.

The reason economists favour sales taxes is they tend not to distort behaviour as much as other taxes. They apply broadly and evenly. The empirical evidence on this is also quite clear. A broad-based sales tax tends to be less damaging to the economy than corporate or personal income taxes. So, when economists are asked how governments should raise revenue, they typically point to a sales tax.

The objective of carbon pricing, however, is not itself to raise revenue but to correct a market failure. Where is the failure? Pollution causes damages, and those doing the polluting don’t take those damages into account. To correct this failure, one can use either inflexible government regulations or what’s called a Pigouvian Tax. The latter approach relies on decentralized decisions in the market to abate pollution, while the former relies on centralized decisions by governments. As markets are generally more efficient, economists broadly support carbon pricing.

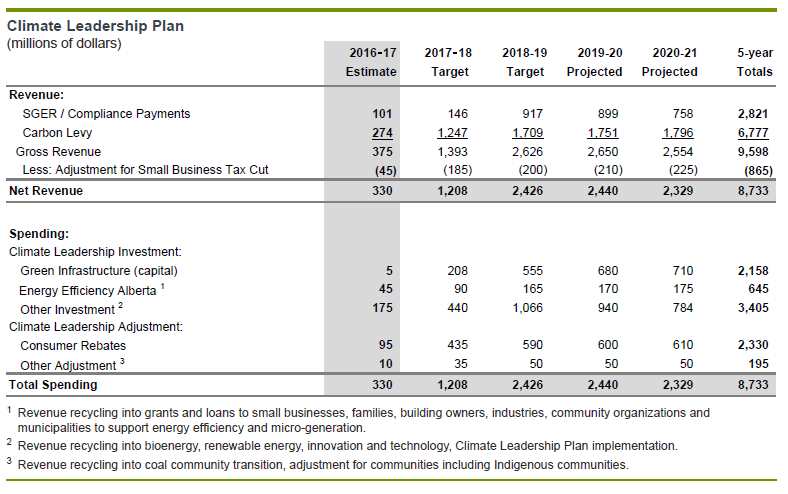

To be sure, carbon taxes do raise revenue. For Alberta, the carbon tax and net revenue from pricing the emissions of large emitters will raise nearly $2.6 billion per year (once fully ramped up).

This is roughly equivalent to the amount of revenue generated by a 3 per cent sales tax in Alberta. But that doesn’t mean a carbon tax is a PST. Not at all. Last year, Alberta raised about $2.5 billion in resource royalties. Is a carbon tax then a resource royalty? No. The government also raises about this much from gambling and liquor licenses, plus net income from ATB. Is a carbon tax then a casino or a bank? No.

But, some might point out, the carbon tax is being used to increase government spending just as some suppose a PST would. They are spending the money on infrastructure, energy efficiency, and the like. That’s true, they are spending a great deal of the money. Here’s the relevant table from the budget:

But it’s important to separate the use of carbon tax revenue from the nature and merits of the tax itself.

It’s true that many economists favour an alternative revenue-neutral approach, where other taxes (in particular corporate and personal income taxes) are lowered by an equal amount as the carbon tax brings in. For strong arguments in favour of this option, see this report by my University of Calgary colleague, Ken McKenzie. But there are also those against (see this, for example). There are many options, and governments must choose wisely. This is an entirely productive and helpful debate to have. But regardless of where you come down on it, a carbon tax is not a PST, whether the government spends the money raised or not.

Different Tax Bases

We’ve seen that a sales tax applies broadly on almost all goods and services, while a carbon tax is specific and applies only to carbon. That is, their tax bases differ.

But, some say, we pay the carbon tax at the point of sale, such as when we buy gasoline for our cars or natural gas for our homes. Thus, they are a sales tax.

This isn’t helpful. By this logic, all taxes are sales taxes. Payroll taxes are on the sale of labour by an employee to an employer. Income taxes are as well. Does that mean they are both sales taxes? No. Let’s stretch this logic even further with property taxes. The value of your home is roughly the value of all future housing services it provides. Even if you don’t explicitly rent your home to someone else (a sale), you implicitly rent from yourself (a “sale” … to yourself). So are property taxes sales taxes? No.

Different Legal Implications

Economics aside, there are interesting legal implications of whether a carbon tax is a PST or not.

For the past 21 years, the Alberta Taxpayer Protection Act requires a referendum to implement a PST in Alberta. So, if a carbon tax is a PST then a referendum is required. (Of course, the Act doesn’t really do this. It’s theatre. Any government could repeal the Act first, and then bring in a PST. The Act simply increases the political costs of implementing a PST.)

For a clue to how the law treats each type of tax, I can think of two easy places to look.

In Canada, laws around federal and provincial financial arrangements classify taxes. Specifically, let’s look at the equalization formula. The entire formula is based on a province’s ability to raise revenue across a wide variety of tax instruments. The regulations governing the system classify general sales taxes and carbon taxes differently. (For those nerdy enough to want to know: a carbon tax is a s4(c)(xv) tax while a PST is a s4(c)(i) tax.) So, a carbon tax is not a sales tax.

Next, the OECD also systematically and authoritatively classifies taxes. (Thanks to Kevin Milligan for pointing this out.) While it doesn’t specifically list “carbon taxes,” sales taxes (item 5112) are differentiated from specific taxes on goods and services. A tax on gasoline is not a sales tax, it’s a specific tax on gasoline (an excise tax, item 5121). A carbon tax is similar. It is a specific tax on carbon. If you don’t want to call a carbon tax a carbon tax, then I suppose you could call it an excise tax. But not a sales tax.

Concluding Thoughts

When we hear “sales tax”, we don’t think of income taxes, payroll taxes, or property taxes. We think of a PST, the GST, or an HST. Given that people hate sales taxes, the political motivation to couple carbon taxes to sales taxes is clear. But it also dangerous.

George Orwell wrote that political language is designed to make lies sound truthful. That is precisely what is going on in the carbon tax debate in Alberta. Luckily, politicians, like all of us, respond to incentives. If we demand clarity in words and respectful policy debates, then our political leaders and public commentators will respond and we will all be better off for it.