Kathleen Wynne’s attack on the Ontario PC carbon tax plan misleads voters

Opinion: Wynne is wrong when she claims the Conservative carbon tax plan will cost families more than cap and trade and do less to cut emissions

Ontario Premier Kathleen Wynne listens to questions from the media during an announcement which outlined a cap and trade deal with Quebec aimed at curbing green house emissions, in Toronto on Monday, April 13 2015. The plan involves government-imposed limits on emissions from companies, and those that want to burn more fossil fuels can buy carbon credits from those that burn less than they are allowed. THE CANADIAN PRESS/Chris Young

Share

Carbon taxes versus cap-and-trade will be a critical issue in the 2018 Ontario election. The opposition Conservatives propose to scrap the current cap-and-trade system and shift to a carbon tax administered through the federal government’s backstop program. The governing Liberals counter that this will cost families more and result in lower emissions reductions.

In recent comments, Ontario Premier Kathleen Wynne claimed “there’d be higher costs for home heating, filling up your car with gas. A carbon tax would add about $1,200 in additional annual costs for families with children.” She goes on to claim the cap-and-trade system is “more effective at reducing greenhouse gas emissions.”

READ: How provinces can help Canada meet its emissions target

On both the added cost to households and the effect on Ontario’s emissions, the Premier is very wrong. I’ll explain.

The Cost to Households

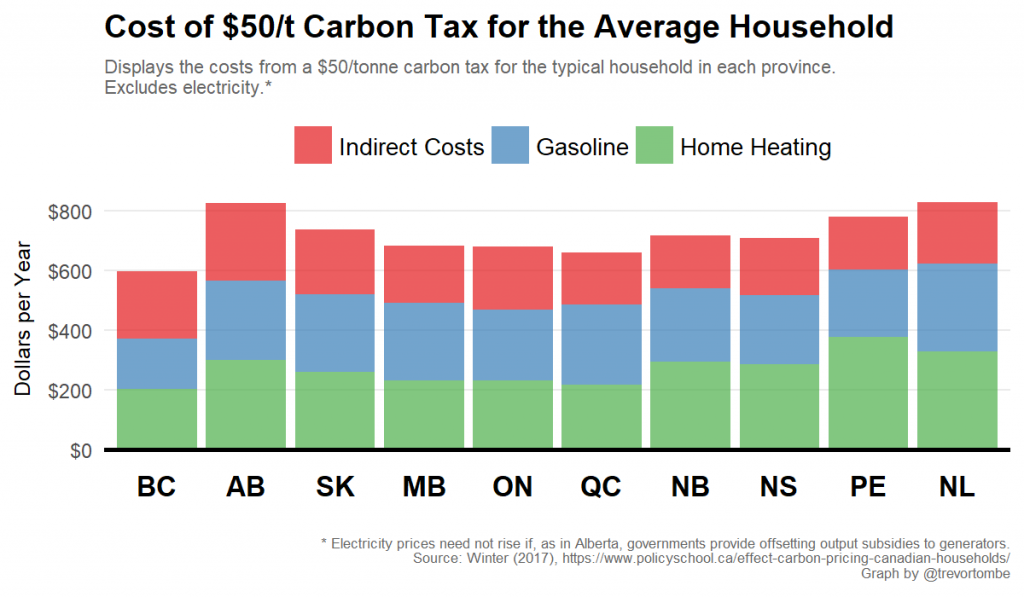

How much carbon pricing will cost households depends on their fuel use, and what type of products they buy. Many estimates exist; the best are found in recent analysis for the Senate of Canada by professor Jennifer Winter of the University of Calgary. She estimates the cost from a $50 per tonne carbon price for the typical household in each province. I display her results below.

For Ontario, the costs are less than $700 on average. For families with children, I estimate costs of less than $900 on average. The $1,200 referred to by the Premier is based on some recent analysis—by me (I think)—that did not try to precisely estimate indirect costs. The $1,200 should be seen as a very generous upper bound. The estimates from Dr. Winter are better. (For more on indirect costs and carbon pricing, with specific reference to Ontario, see this.)

Even worse, the Premier ignores the costs on households that the cap-and-trade system creates. With a carbon price of about $18.50, the average Ontarian household is already facing annual costs of approximately $250. By 2022, the cap-and-trade price will be higher, and household costs will potentially approach $300 per year. A carbon tax of $50 per tonne will therefore add only about $400 per household in new incremental costs relative to the current cap-and-trade system. To say the PC proposal will cost households $1,200 is false.

But that’s not the end of it. The overall cost to households depends critically on what governments do with the money. And the Liberal and Conservatives plans are very different.

READ: What if Ontario scrapped cap-and-trade for a carbon tax?

Currently, the cap-and-trade revenue funds various environmental spending initiatives currently worth about $1.8 billion, according to the latest budget figures (page 94). The PCs propose to cancel this spending and instead lower income taxes, boost the sales tax credit (which helps lower income households), provide a partial refund of child care expenses, and provide output subsidies to large emitters (which are build into the Federal program). All together, their proposal reflects a roughly revenue-neutral carbon tax plan (depending on how one views the new child care benefit; this is a debate for another time).

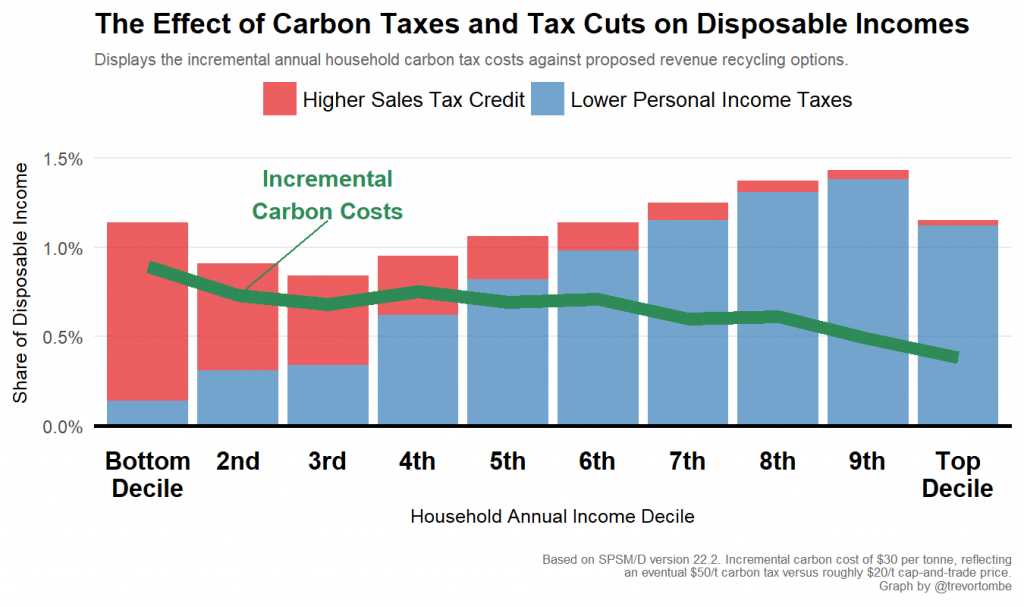

What does this mean for households? Using Statistics Canada’s tax policy simulator, I estimate the effects on disposable incomes of Ontario households. I find that the tax reductions are worth more than the incremental carbon costs that households will face in the transition to the carbon tax system (from $20/t to $50/t). This is true across the income distribution.

Simply put: households would tend to see higher disposable incomes under the PC proposal, not lower as the Premier claimed.

The Effect on Emissions

The Premier also noted that the carbon tax plan will result in less emissions reductions than the cap-and-trade system. While not blatantly false like the claim about household costs, this statement is still somewhat misleading.

What matters for Ontario’s emissions is not the system per-se, but the price on carbon. At $50 per tonne, the PC proposal would imposes a price by 2022 that is more than double what the current cap-and-trade system would. Will this higher price result in lower emissions? Yes. Any decision that costs more than $20 per tonne of avoided emissions but less than $50 will not be undertaken under the current cap-and-trade system, but will be under the proposed carbon tax. With a higher carbon price comes lower GHG emissions.

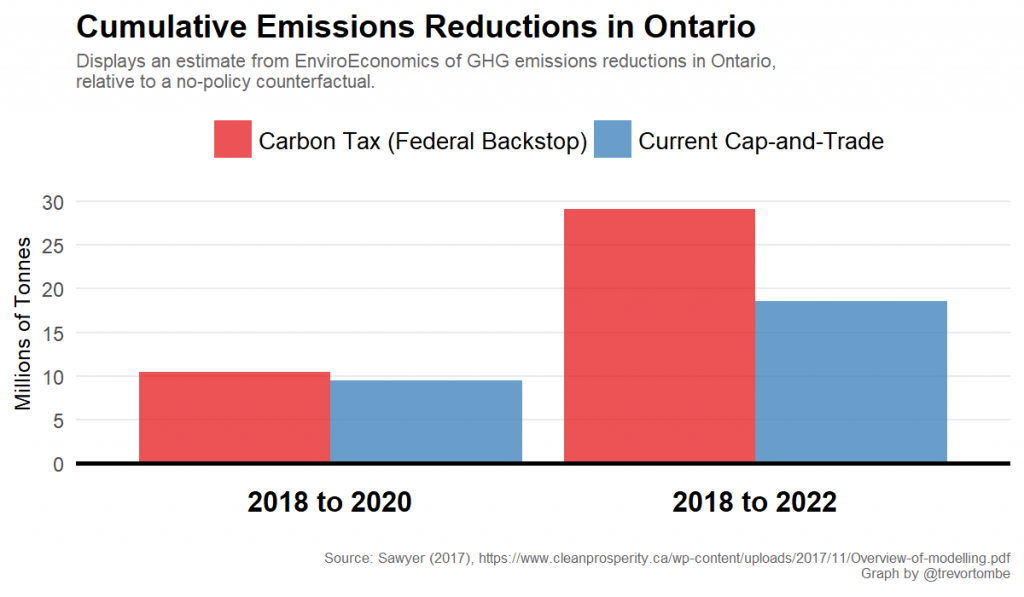

Quantifying this is difficult, though recent analysis by EnviroEconomics (a reputable consultancy with extensive experience in this area) does just that. They forecast 172 million tonnes of GHG emissions in 2022 with no policy action, 167 million under the cap-and-trade with a $22/t price by 2022, and 161 million under the proposed carbon tax system with a $50/t eventual price. Below I display the estimated cumulative emissions reductions for each policy.

That being said, the cap-and-trade system will contribute to lowering global emissions above and beyond reductions in Ontario, since firms in Ontario will effectively pay firms in California to lower emissions on their behalf. There’s nothing wrong with this in principle, but some are concerned about the validity and quality of those reductions in California. It also introduces other economic concerns around the capital outflow these purchases require.

Overall, the carbon price should be our measure of stringency. And on this metric, the PC proposal is more stringent than the current system.

Concluding Thoughts

As Ontario gears up for a rigorous election debate on an important policy issue, it will be increasingly difficult to distinguish good information from bad. This is unfortunate. Politicians have an important role in society and should strive to facilitate calm, fact-based public debate on important policy issues. And there are reasonable grounds for people to disagree. Some prefer the certainty over the path of future emissions that the cap-and-trade system provides, while others prefer the certainty over future costs that the carbon tax system provides. Some prefer to spend carbon revenues on energy efficiency programs and the like, while others prefer a revenue-neutral approach. Focusing on these issues is productive; misleading voters into rejecting a straw man version of an opponent’s proposal is not.

Trevor Tombe is an associate professor of economics at the University of Calgary, and a research fellow at the School of Public Policy.

MORE ABOUT CARBON TAX:

- The NDP’s carbon tax increase puts B.C. on a very different path

- Why Canada’s carbon pricing plan should give money directly to Canadians

- GST on carbon taxes in Alberta, B.C. worth millions in federal revenue

- The real lesson Ontario can take away from B.C.’s carbon tax

- It’s time for clarity on Canada’s climate and energy policy

- Making sense of Alberta’s new energy efficiency program

- Alberta’s carbon tax rebate cheques start flowing