Making sense of a $15 minimum wage in Alberta

Alberta’s proposal for a $15 minimum wage is unlikely to have much of a negative impact on employment, but that doesn’t mean it’s the best option

(Shutterstock)

Share

Raising the minimum wage is a hotly debated topic these days. New York, California, Seattle, and Washington, D.C., are all on their way to $15. Closer to home, the Alberta government has promised to raise the minimum wage to $15 by 2018, the B.C. NDP will include it in their 2017 election platform, and Ontario’s NDP is on board too.

But is a higher minimum wage good public policy? It’s a tough question. Proponents argue that rising inequality and higher costs of living make increasing the minimum wage not only necessary, but also fair. Opponents counter that the economic consequences are too severe, or that other policy options are superior.

On “fairness,” we can provide little insight. But there are other aspects of the debate that are less subjective, where evidence can weigh in.

So let’s take a step back, put aside whether the minimum wage should increase or not, and start with a few foundational questions. Just how large is a $15 minimum wage? Who benefits? What effects might it have on jobs? And finally, is a higher minimum wage the best policy tool available, or can we do better? Thankfully, some readily available data and some recent research can provide some answers.

What does a $15 minimum wage mean?

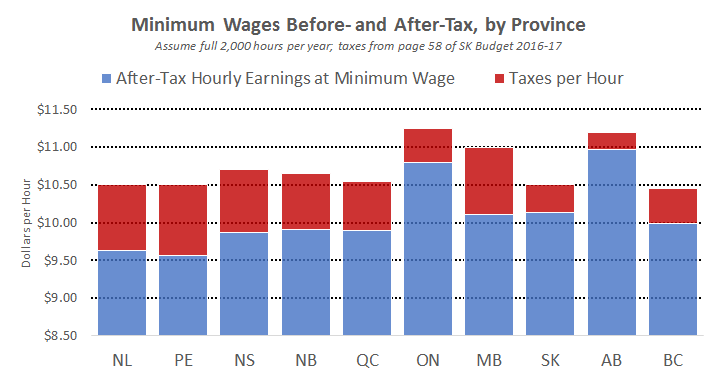

First, how does Alberta’s minimum wage compare to other provinces? Below we plot each province’s current minimum, before- and after-tax. (This includes income taxes, health premiums, sales taxes, all net of credits and rebates. See page 58 of this.)

It’s clear that Alberta’s minimum wage is higher than elsewhere. It’s currently $11.20, with only Ontario on par with a minimum wage of $11.25. When taxes are factored in, Albertans earning the minimum take home nearly $11 per hour, which is much higher than elsewhere.

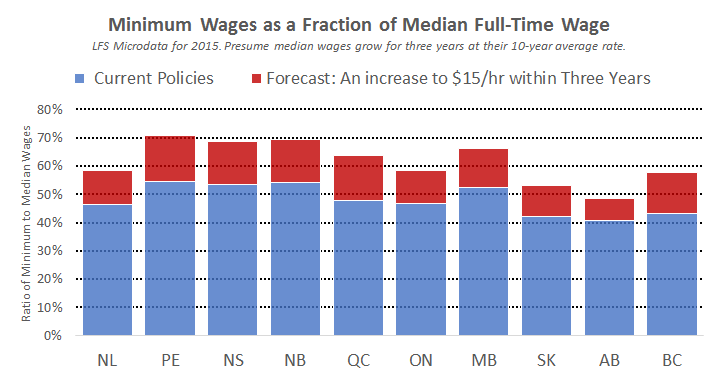

But this doesn’t tell the whole story. When we look at the minimum wage as a percentage of the median wage, Alberta falls to the bottom. We plot this result below in blue. Currently, Alberta’s minimum wage is 41 per cent of the median of full-time workers, compared to 47 per cent in Ontario, 48 in Quebec, and 43 in B.C. and Saskatchewan.

Next, we forecast this ratio three years into the future if each province increased their minimum wage to $15. We plot the result above as the red bars. It’s clear that a $15 minimum wage by 2018 only puts Alberta where Ontario and Quebec are now. At that point, the minimum will barely exceed 48 per cent of the median.

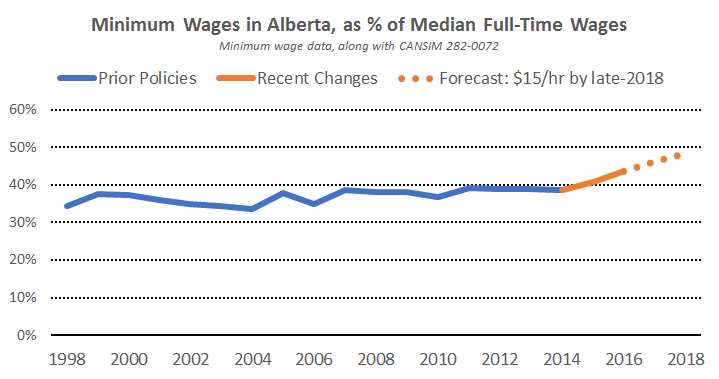

For some perspective, the average OECD country has minimum wages about 50 per cent of the median (see this). In that context, a move to $15 in Alberta seems reasonable, getting us in line with the Canadian and OECD average. But it’s still a sizable change relative to the past, where Alberta’s minimum-to-median ratio hovered between 35 and 40 per cent. We plot this below.

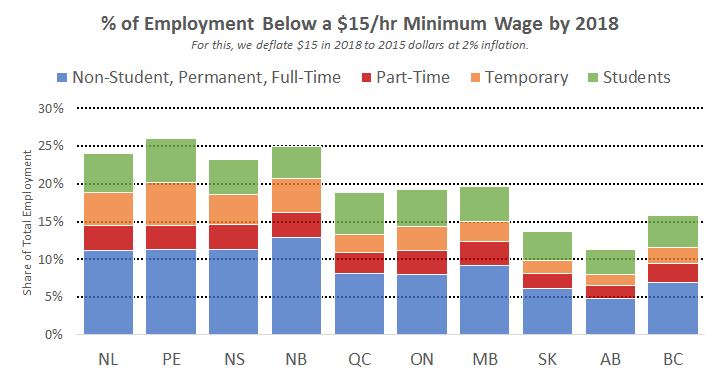

Finally, it’s important to know how many workers will be affected, and who they are. The more workers affected, the more a higher minimum wage is likely to produce both benefits and costs. To estimate this, we plot the share of employment in each province earning less than $14.13 per hour in 2015 (the equivalent of $15 in 2018, with two per cent inflation).

The combined height of all bars is the share directly affected, and we further break it down by type of worker. Roughly speaking, 11 per cent of Alberta’s workers will be directly affected by the increased minimum, with about five per cent being non-student, full-time workers at permanent jobs. This is far less than most other provinces. (Though it’s rough. On the one hand, some workers are exempt from minimum wages, but on the other hand, workers earning close to but still above any the new minimum will also be affected. There’s important recent work on this latter point.)

Of course, none of this is sufficient to conclude either that Alberta should or shouldn’t increase the minimum wage. Instead, it provides context: an increase to $15 is not dramatically different than current minimum-to-median wage ratios in other provinces, and will affect a smaller share of the workforce than elsewhere.

Will higher minimum wages lower employment?

Given a move to $15, what, if anything, will the consequences be for the broader economy? In particular, will there be job losses?

The research is ongoing. Many earlier studies find small negative effects, especially for teenagers or low-skilled workers. (For reviews, see this, this, or this.) But some more recent research, with potentially improved techniques, find no effect at all. This may seem puzzling. After all, if demand slopes downward, then shouldn’t a higher minimum wage lead to lower employment? But there are a few possible channels that confound this intuition. We won’t discuss them here, but see this paper for a comprehensive review.

Of course, there’s still a debate and more research is needed. Some researchers reviewing the same literature reject minimum wages as effective policy, while others very much support it. But it’s safe to say the effect on employment will (at most) be modest.

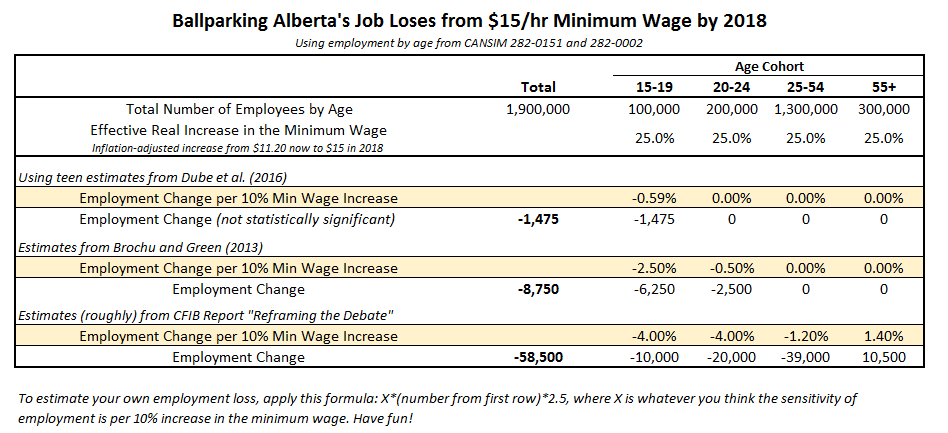

How modest? To illustrate, we take three estimates from the literature (this, this and this) and project them onto Alberta’s labour market. We display the result below, with the total job losses in each scenario in bold.

The first scenario, based on the latest estimates, shows essentially no losses. The second scenario shows larger losses, approaching 9,000, as those researchers find larger negative effects for teenagers and non-zero effects for young adults. The third scenario, put forward by the CFIB, applies a seemingly small elasticity to adults. With so many adult workers out there, the estimated job losses mount and exceed 50,000. To be clear, we view this result as harder to justify from a comprehensive reading of the recent research literature, where adult employment effects are nil.

To be sure, the effects differ across industries. Restaurants Canada—an industry lobby association—is critical of the Alberta government’s plan. Of all industries, hospitality and retail will be under the greatest pressure from higher minimum wages. So even if there is no aggregate effect, employment and economic activity may still shift across sectors.

Can we do better?

The goal of a minimum wage is to provide higher incomes to lower-income individuals and families. But will the benefits of a minimum wage do that? Currently, roughly 25 per cent of those affected by a move to $15 are teenagers—not likely the intended targets for poverty alleviation.

But a higher minimum wage is not the only policy instrument. If policy-makers want to get people to $15, they can do it even if the minimum wage is lower. An Earned Income Tax Credit (EITC), or in Canada’s case the Working Income Tax Benefit, for example, offers a compelling alternative. The EITC is in effect a wage subsidy targeted specifically to low-income individuals and families.

The wage subsidy has some advantages. First, it is much more effective in targeting the income group that minimum-wage advocates are trying to help. Second, as a wage subsidy, the risk of lower employment disappears. It may even increase employment (see this or this).

As a bonus, it is closely related to policy we already have. The Alberta Child Benefit directly subsidizes wages of lower-income parents, depending on how many children they have. If you make $20,000 per year, the total benefits available are just over $3,000. It then declines with income.

This is great policy that has broad support in all parties. It was first proposed by Prentice’s Conservatives, and implemented by Notley’s NDP. Why not expand it to more people? Why not allow those without children to benefit too? To, in effect, drop the “C” from the “ACB”.

To be sure, the EITC is no panacea. In contrast to the minimum wage, it requires public funds and cost hundreds of millions, potentially billions, of dollars. Given Alberta’s fiscal challenges, any additional costs are no small concern. There is also evidence that some of the wage subsidy is captured by firms in the form of lower wages. Though on this point, minimum wages can nicely complement an EITC, as they prevent firms capturing too much of the wage subsidy.

Putting it all together

Overall, $15 is neither extreme nor unreasonable as a minimum wage. It brings Alberta closer to other jurisdictions, and the employment effects, though far from clear, are unlikely to be large.

But a minimum wage is only one tool at our disposal. A well-designed EITC may be sufficient to provide low-income households with effective wages that meet or exceed the targeted $15. Focusing solely on an increased minimum wage, to the exclusion of all other policies, is not helpful and sells the goal of poverty alleviation short. Equally unhelpful is a blanket rejection of any increase to the minimum wage when such a rejection is based on concern for large-scale job losses. Opposing such policies in principle is one thing; making exaggerated job loss claims is entirely another.

There is a middle ground, and an explicit and targeted wage subsidy program—such as an expansion of the size and scope of the Alberta Child Benefit to include individuals and households without children—should be a much more prominent part of the conversation.