Why the Liberals and NDP shouldn’t bank on having surpluses to spend

If you’re buying into Harper’s surpluses, you’re also buying into Harper’s austerity program

Share

The fiscal update projects a small deficit in the current 2014-15 fiscal year, and ever-increasing surpluses in the following four years. These surpluses are being viewed by some as manna, and that the next election will be fought on the question of how they should be allocated: tax cuts, spending increases or some combination. But we are by no means back to the days of the early 2000s, when federal revenues were embarrassingly abundant. The surpluses in today’s fiscal update are based on projections that assume that the pattern of the last five years of spending restraint will be repeated over the next five years. Briefly put, if you’re buying into the CPC government’s surpluses, you are also buying into its austerity program.

The best way to view movements in government revenues and expenditures over time is as a fraction of GDP. On the revenue side, this is relatively straightforward: revenues will increase as the economy expands. This is equally true—but less straightforward—on the expenditures side. It turns out that in addition to increasing revenues and everything else being equal, economic growth also increases the cost of providing a given level of services. Here’s why:

GDP growth can be decomposed in three components:

1. Inflation: Everything else being equal means that the buying power of wages paid to federal civil servants remains constant. As prices increase, so do the cost of paying public sector workers.

2. Population growth: Everything else being equal, a larger population implies an increased demand for public services.

3. Real, per-capita economic growth: Everything else being equal, real-per-capita economic growth translates into an increase in real wages. If real wages are increasing in the private sector, public sector employers will be required to match those gains.

This, incidentally, explains my eye-rolling dismissal of Justin Trudeau’s “The answer is growth” in his economics video. Economic growth does increase revenues, but unless you’re planning on depriving civil servants of the benefits of economic growth, it also increases costs.

I’ve gone over the mechanics of the Conservatives’ long-term budget agenda several times, most recently here. There are three main components:

1. Transfers to persons have been pegged at a constant fraction of GDP, and so have increased with the size of the economy.

2. Transfers to other level of governments (mainly provinces) have also been pegged at a constant fraction of the economy.

3. Direct program expenditures—that is, wage costs and spending on goods and services—have generally been held constant. Since GDP has been increasing, this means that direct program expenditures expressed as a share of GDP have been gradually declining.

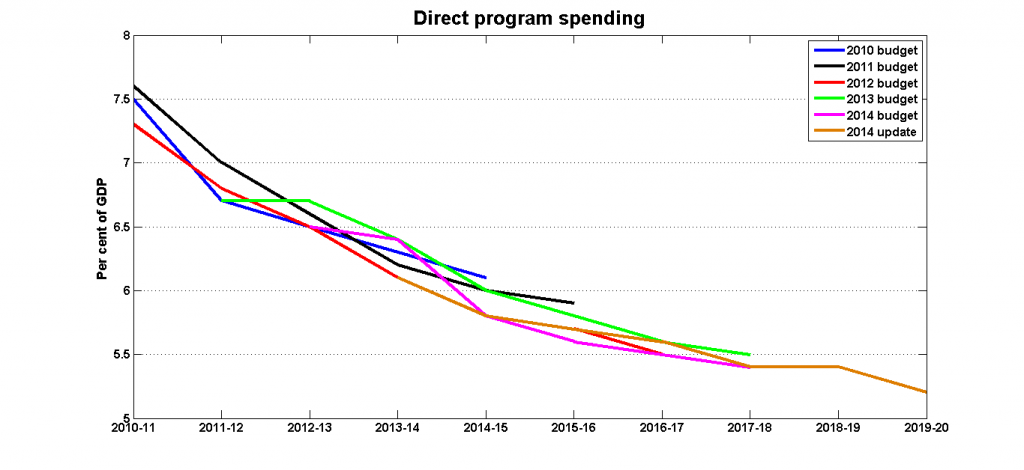

This chart shows the projections for direct program expenditures for the past few budgets:

This gradual erosion has manifested itself in several years of grinding austerity throughout the federal public service. And the fiscal update calls for more of the same, as far as the eye can see. The recognition that this pattern of austerity is baked into the government’s projections changes—or at least, should change—your perception of those projected surpluses. This is not free money that will fall into the government’s lap; it’s money that is to be carved out of future program spending.

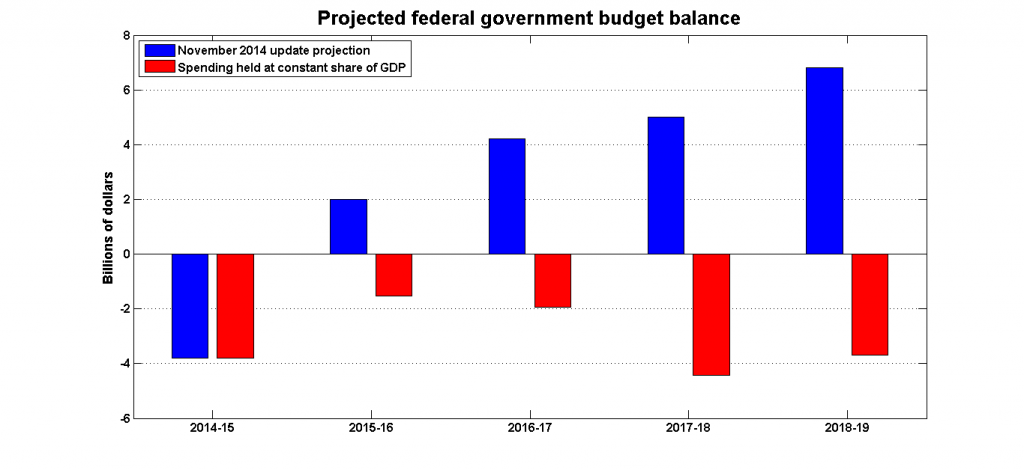

I’m going to reproduce the exercise I went through last February: what if direct program spending were projected to increase with GDP after the current 2014-15 fiscal year? This doesn’t mean that previous reductions in spending as a share of GDP would be reversed, just that no new ones would be made. Here is what happens to the projected budget balances during the fiscal update’s projection horizon:

Without continued austerity, those projected surpluses are transformed into projected deficits.

The Conservatives are presumably comfortable with the idea of using those projected surpluses to finance tax cuts and to continue to hold the line on direct program spending. But the Liberals and NDP should be wary about incorporating these projections into their plans. Saying that you want to use those “surpluses” to finance new spending is the same thing as saying that you’re going to cut back elsewhere.