After 20 years, NAFTA needs a jumpstart

If NAFTA were to regain the momentum it had from 2000 to 2007, it could see up to $40 trillion of annual trade over the next two decades

Share

Twenty years after its creation, the North American Free Trade Agreement is a force to be reckoned with. Its members—Canada, Mexico and the United States—together form the world’s largest economy, with over $20 trillion in GDP in 2014. With its large market, innovation base, abundant natural resources and talented and productive workers, the region rates as an attractive investment destination.

Yet NAFTA is unfinished business. After two decades of integration, the region’s internal linkages still need to be strengthened. Direct links between Canada and Mexico are few; almost all of the two countries’ regional trade, investment and people exchanges are with the United States. For the U.S., trade in services with the European Union is three times larger than with NAFTA. The links that do exist tend to be dominated by a few industries; in contrast, the EU’s internal trade flow covers a wider range of sectors.

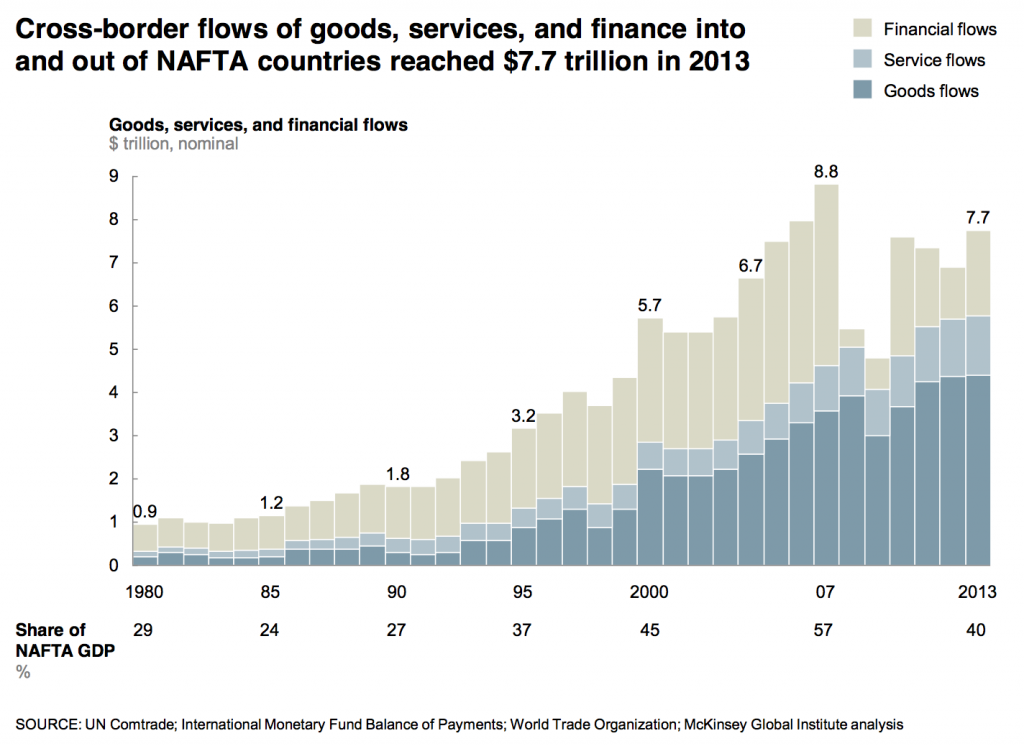

Moreover, since the 2008 recession and initial recovery, the trend toward greater interconnectedness that marked NAFTA’s first decade has slowed.

Given the adjustment costs, it has become much harder politically to justify deepening or broadening the interconnections, as evidenced by heated debate around the Trans-Pacific Partnership. This is a lost opportunity, because countries see faster GDP growth when they are more closely linked with a regional and global economy. NAFTA does only half as much trade in goods as the EU and one-fifth the trade in services. The internal goods trade flows within ASEAN, the 10-country Asian trading bloc, are growing 50 per cent faster than NAFTA’s.

NAFTA should seek to expand its linkages, regionally and with the global economy, because it needs growth opportunities. Among its future challenges are an aging and shrinking workforce; over the next 50 years, aging could slow Canada’s GDP growth rate by 50 per cent, the steepest decline of any advanced economy in the G20. Productivity growth in NAFTA has slowed since 2008, increasing the risk to economic growth. And fierce global competition is under way for investment, talent and profits, all of which are shifting rapidly to Asia.

We estimate that if NAFTA over the next two decades were to regain the momentum it had from 2000 to 2007, it could cement its position as the world’s most competitive region and see up to $40 trillion of annual trade and financial flows by 2035—a five-fold increase from today. That in turn could feed through into more jobs and GDP growth.

But these benefits will come with further adjustment costs. They are hard to pinpoint and quantify but likely include job losses, especially in manufacturing and associated service sectors. Other challenges from greater integration include money laundering and sizable flows of weapons and drugs. To address such issues, NAFTA countries will need coordinated actions to mitigate the societal costs and maintain much-needed public support for greater integration.

Who should take the lead? NAFTA may not see integration purely through political and regulatory change, as was the case with the EU’s Single Market in 1992. Yet even when business takes the lead, as with the U.S. auto industry’s investments in Mexico, policy must smooth the way—for instance, with the loosening of import quotas, tariffs, rules of origin and other regulatory constraints. Priorities include:

1. Broaden the NAFTA economy. A handful of industries currently dominates NAFTA’s flow of goods and services, and there is room for many more sectors and different sizes of firms to participate more fully. The automotive industry is well integrated, for example, but the energy sector is less so—and other goods industries lag even further behind. Closer integration could also foster trade in professional, legal and financial services. Smaller companies in the region could become more productive and competitive if they participated more in the NAFTA economy. Large Mexican firms can now get funding at costs comparable to their U.S. counterparts, but NAFTA has done little for smaller firms that continue to pay 20-25 per cent interest rates.

2. Remove bottlenecks to create easier and faster movement. The Mexico-U.S. border is among the most-crossed borders in the world, so even minor improvements can go a long way. Congestion at goods transit points can be acute, with commercial trucks sometimes logging four-hour wait times. Energy pipeline infrastructure hasn’t kept pace with fracking activity, leading to rail shipments of crude oil. Such bottlenecks could grow worse with the widening of the Panama Canal or the expansion of regional energy and manufacturing supply chains. Better project selection, execution and operation could significantly improve the productivity of existing and new infrastructure—and can attract significant private-sector investment.

3. Align NAFTA’s legal and regulatory framework. Of the three countries, only the U.S. ranks in the top ten for ease of doing business, innovation and competitiveness in the World Bank and World Economic Forum rankings. Regulations vary widely within NAFTA, on everything from construction permits to contract enforcement. The region can be made more attractive, first by uniformly enforcing the fundamentals such as rule of law, and then by gradually harmonizing pricing and regulations ranging from tax rules to IP protection. Industries with large economies of scale such as telecom and transport could benefit. More opportunities for joint R&D and customer service can also enhance NAFTA’s attractiveness.

4. Encourage the flow of people and deepen the talent pool. For companies increasingly worried about finding and retaining talent, NAFTA could do more to promote greater flows of people, especially business travellers and students. Mexico graduates half a million students every year but sends fewer students to U.S. universities than do Vietnam or Saudi Arabia. Reversing the decline in labour mobility is also a priority, as is workforce training; today, there are large geographic and skill gaps between companies, workers and schools across the region. Aggressive immigration—even from within the region—could also help counteract the challenge of aging populations.

Twenty years on, NAFTA is at a critical juncture. Its results have been impressive, but there are still opportunities to improve. As momentum slows, a fraying political consensus has added pressure for NAFTA to prove itself, not only for the sake of North America but for the continued health of free trade. If North America is to remain competitive at a time of demographic shifts, fast-growing global competitors and a rapidly evolving global international landscape, NAFTA must deliver more fully on its potential. Governments and the private sector both have a significant role to play in helping it to finish its business.

Dominic Barton is the global managing director of McKinsey & Company. Bruce Simpson, director of McKinsey & Company Canada, also contributed to this article.