Thinking out loud about an Alberta PST

Colby Cosh looks for a clear path for Jim Prentice, and comes up wanting

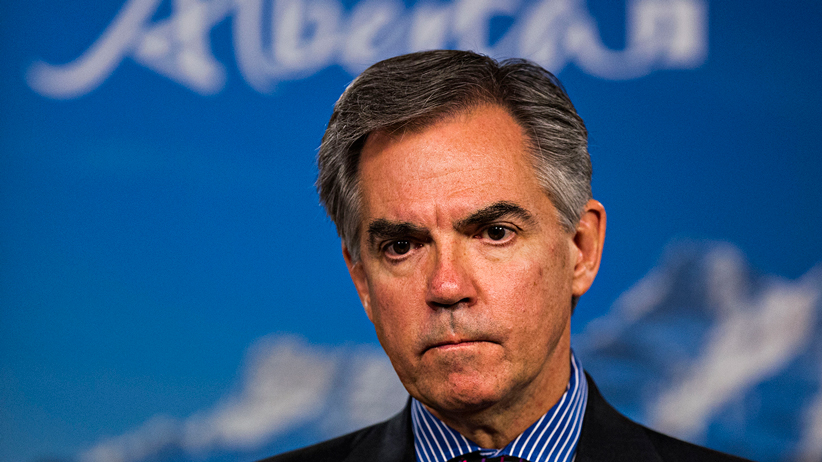

Alberta Premier Jim Prentice speaks about the licence plate situation at the Alberta Legislature Building in Edmonton, Alta., on Thursday, Sept. 18, 2014. Prentice said there will be no new licence plates.

Share

Yeah, look, guys. I realize that Jim Prentice is talking about the possibility of a provincial sales tax for Alberta. I think he’s just trying to make sure he has our FULL ATTENTION before he passes a very austere budget, because I do not see a clear path toward us actually having a PST.

Under current Alberta statute—the Alberta Taxpayer Protection Act (ATPA)—Albertans would have to vote “yes” in a province-wide referendum before a PST could be introduced. The government gets to write the referendum question, which as we all know is a big advantage, but the economists who support a PST have not done anything like the necessary public outreach and education to soften up superstitious, PST-averse voters. The PCs are obviously hell-bent on a spring election, and spring seems far too soon for that sort of gamble, although the referendum could be held on the date of the general election.

It is more likely that if Prentice sincerely wanted a sales tax, he would try for repeal of the ATPA without an official referendum. Prentice could make that a centrepiece of the upcoming election campaign—a “no me without a PST” kinda offer—but then opposition parties and troublemaking journalists might ask why there is no formal referendum being held in parallel with the election. The whole point of the ATPA was to prevent premiers from forcing package deals of that sort onto voters.

And, of course, Albertans might actually take the “no me” option, rejecting a Conservative government in favour of … Stop laughing! It could totally happen!

Prentice could simply keep quiet about sales taxation during the campaign and spring a repeal of ATPA on us later. With as much political capital as he has right now, having obliterated the official Opposition by means of a quiet chat over coffee, maybe he could pull it off. But I doubt it. Tax surprises really bring the knives out—ask Greg Selinger.

Related:

Why the oil crash caught so many by surprise (but shouldn’t have)

Leach: Is it time to panic in the oil sands?

The Editorial: Oil prices are falling—but it’s hardly doomsday

Kirby: Why the oil crash is bad for Canadian housing prices

If Prentice believes that a PST is in fact inevitable, that seems more like something he would bring in in, say, year two of a fresh mandate—late in year two, and only with heavy, constant, unanimous assistance from many leading economists and policy types, preferably ones with some right-wing credibility. The Progressive Conservatives would have to persuade someone in or near the cabinet to make an unpleasant full-time job of it for a while.

Since the idea seems to be to use a PST to raise extra revenue, he may have some trouble getting the tougher-minded economists on board. Jack Mintz, possibly the single most-respected economist in the province, talked about introducing a PST in a revenue-neutral way when times were good and West Texas Intermediate was still in the neighbourhood of three digits. If a tax hike must come in Alberta, a PST is likely to be a good way to do it—from an efficiency standpoint, that is: from the standpoint of minimizing abstract economic distortion. But no tax hike is going to be popular, especially on the outer verge of a possible provincial recession. The economists may actually recommend just borrowing more money while it’s still cheap, especially for AAA-rated Alberta, to do so. Goggle-eyed ninnyhammers, the lot of ’em!

Prentice’s rough talk highlights the carelessness of the post-Klein premiers who failed to control public spending during a boom, thus possibly necessitating a countercyclic tax grab that would amplify the immiserating effects of an oilpatch bust. I am not necessarily convinced that a tax grab is necessary, and neither is Prentice, yet. The labour left insists that Alberta is having problems now because it mistakenly failed to “diversify” its economy in the ’90s and ’00s through activist industrial planning. But by crude GDP measures, the Alberta economy actually diversified pretty impressively away from oil and gas under Ralph Klein. More to the point, it grew awful fast, too.

What one really notices, in looking at Alberta’s position under Ralph Klein and his successors, is that in Klein’s last year, fiscal 2006-07, the government’s total expenses came to just under $30 billion. For 2013-14 the figure was just under $50 billion. Why’d that figure grow by two-thirds when the population increased by a quarter and inflation added about one-eighth? In real per-capita terms, Alberta’s government seems to have gotten about 30 per cent more expensive in seven years.

Personnel costs are a big reason: Klein’s successors gave exceedingly generous deals to nurses and teachers, arguing that in a tight labour market Alberta had no choice but to pay competitive prices for those workers. The natural corollary of that, if there is to be a recession, is to give them their share of the agony. (What the public sector unions will argue is that it’s more important than ever in hard times to make sure all those frontline flak-catching heroes are amply compensated. Then, when things get better, they’ll switch back to the original argument.)

As far as our net financial position goes, the Alberta government has maintained the nominal quantity of its assets post-Klein, but it exchanged cash flows for much greater book value in infrastructure. In plain English: it bought a whole buncha crap. The natural corollary of that is to monetize infrastructure as much as possible, through privatization or user fees. Road tolls, to pick the most obvious of what must be a hundred ideas, have already come under much more earnest discussion in Alberta than a PST yet has.

Charles Krauthammer recently made a splash by reiterating his old “conservative case” for a large, opportunistic gas-tax hike that would, for the United States, offer significant positive political and environmental externalities. When I read Krauthammer’s column, it struck me that I had already heard Ric Dolphin, who publishes Alberta’s Insight Into Government newsletter, make much the same case for analogous reasons vis-à-vis Alberta. Dolphin even had an extra wrinkle: a hike in gas tax could be structured regressively so as to capture as much of the consumer windfall from the oil crash as possible—the cheaper gasoline goes at the pump, the bigger the tax bite.

Basically, the argument goes that people had gotten used to budgeting for the higher fuel prices of early 2014 … and also that Albertans know that their notorious taste for gas-gulping road behemoths has a certain shameful, Veblenian status-advertising aspect. They might accept a gas-tax hike, though it would be difficult to hit drivers at the pump and with road tolls at the same moment. I expect this sort of thing to hit the agenda long before a sales tax does.