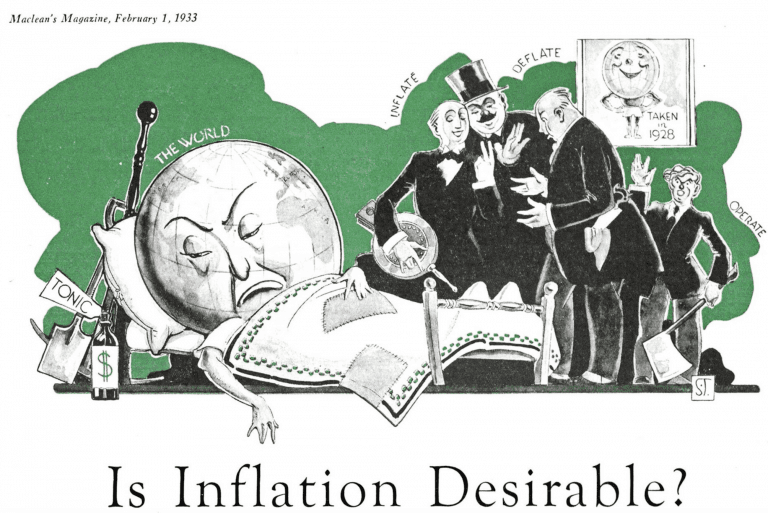

Is Inflation Desirable?

From February 1933: To increase Dominion notes in proportion to current Government deficits . . . . is a thoroughly unscientific and dangerous policy

Share

[widgets_on_pages id=”ArchivesNavigation”]

From The Maclean’s Archives.

Learn more or sign up now for your 30-day free trial.

[bondi_viewer article_key=19330201015 showTitle=false showCover=true showText=true showTab=false showEndWidget=false]

Enjoy more great stories from The Maclean’s Archives. Start your 30-day free trial today.