Encyclopedia of the oil crash: E is for Energy East pipeline

…and election, environmentalists, ethical oil, and exports. View this and more in our encyclopedia of the oil crash

Share

ELECTION (2015 FEDERAL)

A few months after Stephen Harper became Prime Minister in 2006, he travelled to London to tout Canada before a British business crowd as an “energy superpower.” That phrase became famous. Rarely recalled, though, is the wide-eyed way Harper described oil sands development to the Brits that day, calling it “an enterprise of epic proportions, akin to the building of the pyramids or China’s Great Wall.”

In the campaign slated for this fall (unless Harper decides to skirt his own none-too-binding fixed-election-date law and goes to the polls this spring), don’t expect to hear him likening Fort McMurray to ancient Cairo or Beijing. It’s more than just the humbling price of crude that will mute the energy rhetoric in his re-election bid: His failure to orchestrate progress on pipelines also robs him of bragging rights.

Still, having to play down energy won’t prevent him from running on the economy. At the end of 2014, his office foreshadowed Conservative election messaging by boasting of a raft of achievements, from new tax breaks the Tories say will save the average family $1,100 a year, to billions in new infrastructure spending, to “staying on course . . . to balance the budget in 2015.”

That last point is problematic. Independent economists, such as those at Toronto-Dominion Bank, say Harper can only forecast balanced books this year if he assumes the price of oil will bounce back somewhat. That’s far from a safe bet. One possible fix: Finance Minister Joe Oliver might simply forecast a sufficient oil-price rebound in his budget, knowing whether or not he got it right won’t be evident until months after the election anyway. Opposition parties would loudly protest.

Of course, they’ll do that in any event. “Oil prices are through the floor, and Mr. Harper has no backup plan—none,” Liberal Leader Justin Trudeau said recently. Expect to hear many campaign-trail variations on that theme. But Harper has already markedly adjusted his game away from oil, staging events in battleground Ontario last fall to roll out his family tax cuts and infrastructure billions.

[widgets_on_pages id=”A to Z of the Oil Crash”]

It may even be possible, according to pollster David Coletto of Abacus Data, that Conservatives could benefit from just enough, but not too much, economic anxiety. “If people think the economy is really poor, that’s going to hurt an incumbent government,” Coletto says. “If the economy is only kind of shaky, that can help an incumbent government, which can argue it’s not time to change things.” If he’s right, and Harper manages to exploit oil-induced jitters, the coming campaign could be as soaked in irony as the oil sands are in bitumen. John Geddes

ENERGY EAST PIPELINE

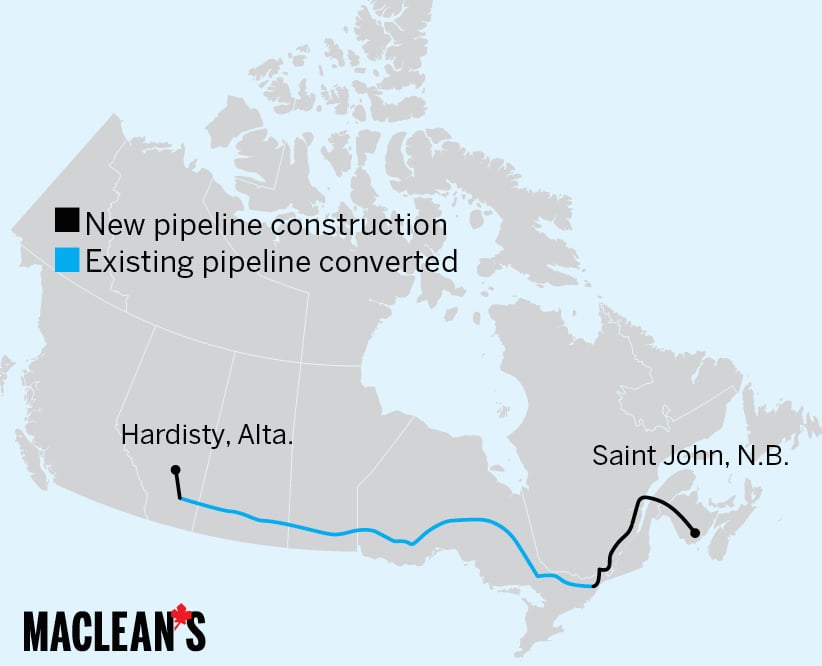

What it is: A cross-Canada route that would run from Hardisty, Alta., to a prospective shipping terminal in Cacouna, Que., and another terminal in Saint John, N.B.

Why it’s needed: Proponents claim the pipeline would transport bitumen more safely than railways that currently move substantial amounts of petroleum.

Why it might not get built: The plans call for the conversion of an existing natural gas pipeline and increased tanker traffic in the Gulf of St. Lawrence. Opponents say the proposal poses huge environmental risks. Nick Taylor-Vaisey

ENVIRONMENTALISTS

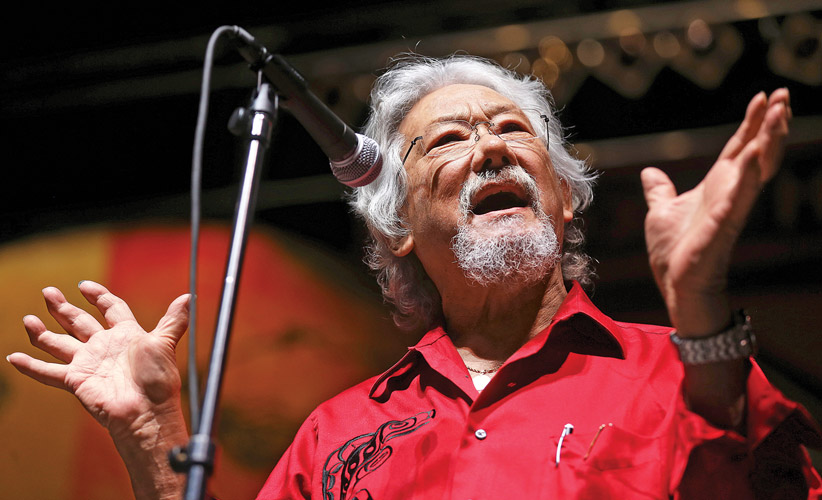

David Suzuki, Canada’s leading environmental activist, on what falling oil prices mean for the Earth:

Plummeting oil prices come with good news and bad, depending on your perspective. As driving becomes more affordable, the number of cars and trucks on the road could increase—good for the auto industry, but bad in terms of pollution, climate change, congestion and traffic accidents. Low oil prices can also boost manufacturing—which could benefit Canada’s fastest-growing sector, clean technology. And because the price of oil is dropping below the cost to extract oil sands bitumen, industry is putting the brakes on rapid expansion plans—bad news for workers, businesses and those heavily invested in the industry, but good news for our planet.

A study by researchers at University College London’s Institute for Sustainable Resources shows that most of Canada’s oil sands bitumen—as well as all Arctic oil and gas, most of Canada’s coal and some conventional oil and gas—must be left in the ground with many other reserves worldwide to avoid a global temperature increase of more than 2° C above pre-industrial levels, the internationally agreed-upon threshold for limiting catastrophic impacts of global warming.

Study co-author Paul Ekins told National Geographic that putting hundreds of billions of dollars into fossil fuel exploration and development is “deeply irrational” economic behaviour. “What would be ideal,” he said, would be to “use the opportunity of this fall in the oil price to start instituting a global carbon tax, which would take some of the volatility out of the prices.”

In recent months, Canadians have seen the results of relying on a boom-and-bust economy, including massive fluctuations in federal and provincial budgets and an unpredictable labour market. This moment presents a once-in-a-generation opportunity to put an end to billions in fossil fuel subsidies and shift away from short-term economic planning. It’s time to start conserving energy and build a clean-energy future that is stable and prosperous in the long term. (Photo: Trevor Hagan/Reuters)

ETHICAL OIL

Ezra Levant, the media personality and conservative commentator, weighs in on whether “ethical oil,” the concept he popularized to promote the oil sands, has staying power:

OPEC has a significant advantage over Canada’s oil sands when it comes to the cost of production, but that is partly due to their lack of labour and environmental protections. Ethical oil, like conflict-free diamonds or fair-trade coffee, is an attempt to brand the morality of oil based on its country of origin. The concept has been adopted by some advocates of the oil sands, including the Canadian embassy in Washington.

Preferring ethical oil is a liberal concept, one implicitly acknowledged by U.S. President Barack Obama in 2008, when he pledged to wean America from OPEC oil in 10 years. But, since his election, Obama has blocked the approval of the Keystone XL pipeline, which would almost exactly displace oil imports from Venezuela with oil sands oil from Canada and fracked oil from North Dakota.

The U.S. State Department has repeatedly said the pipeline’s environmental impact is negligible, and would create tens of thousands of construction jobs. Pictures of oil sands mines might be ugly, but even Andrew Weaver, a climate scientist and B.C. Green party MLA, acknowledges that if every single drop of oil sands reserves were burned all at once, the effect on the world’s temperature would be just 0.03 degrees—a rounding error compared to China’s unrestricted emissions. Most Americans, including most Democrats, want the pipeline approved. But deep-pocketed U.S. foundations have quietly poured millions into anti-oil sands lobby campaigns, and Obama’s veto has earned Democrats tens of millions from at least one billionaire donor.

But even without Keystone XL, ethical oil has found its way to the U.S. in record amounts. Precisely because of the pipeline bottleneck, oil sands oil has traded at a deep discount to OPEC oil, meaning penny-pinching refineries have used everything from trains to barges to get the good stuff over the border. U.S. imports of Canadian oil have reached a new record of more than three million barrels per day.

Ethical oil, as a marketing idea, isn’t strong enough to overcome a presidential veto. But ethical oil, as a way for U.S. refineries to save billions of dollars over OPEC oil, hasn’t needed any salesmanship. Conservative capitalism beats liberal hope and change. (Photo: Stuart Dryden/Calgary Sun/QMI Agency)

EXPORTS

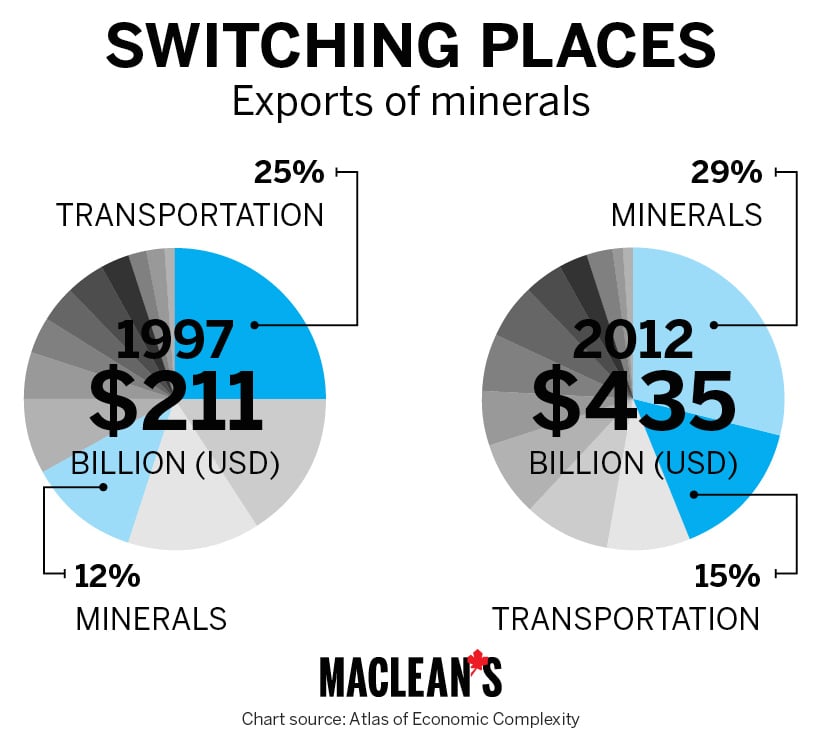

It’s impossible to overstate how important oil has been to Canada’s export picture, and how challenging things could get for the country in the coming months if the value of oil exports drop. Last year, a quarter of all Canada’s exports were energy-related (crude accounted for 18 per cent of the total). Without energy, Canada’s trade deficit of $644 million in November would have been close to $7 billion. Until about a decade ago, transportation exports (including vehicles and auto parts) had consistently been Canada’s largest export, but the high dollar made it more difficult for manufacturers to compete globally. A cheaper loonie will help, but it will take months, if not years, for that to fully work its way through the system. Which means Canada’s trade balance with the world will likely deteriorate further before it gets better. Jason Kirby

NEXT:

F is for First Nations, Fort McMurray, fracking

G is for gas prices, glut, go west

H is for Heritage Fund, housing market