Memo to the Conservatives on climate policy: ‘Take the money, dammit!’

Why reducing greenhouse gases via regulations is the worst of both worlds

Conservative leader and Canada’s Prime Minister Stephen Harper pauses during a campaign event in Montreal April 29, 2011. Canadians will head to the polls in a federal election on May 2. REUTERS/Chris Wattie (CANADA – Tags: POLITICS ELECTIONS)

Share

Maclean’s Aaron Wherry has been documenting the Conservatives’ remarkable sophistry when it comes to carbon taxes and climate change policy (most recently here). As far as I can tell, the Conservatives’ position is the following:

- Market-based approaches such as carbon taxes and cap-and-trade are essentially equivalent.

- Since the Conservatives’ regulation-based plan doesn’t involve revenue generation, it is somehow better than market-based approaches.

The first line is largely correct. It’s the second one that makes no sense. The Conservatives’ rabid demonisation of the phrase “carbon tax” has obscured a point that should be better-known: as bad as you may think a carbon tax (or cap-and-trade) may be, the Conservatives’ regulation-based approach is worse. Regulations introduce large deadweight losses: costs that are not offset by benefits elsewhere. The advantage of market-based approaches is that they transform some of those losses into cash. The Conservatives’ reliance on regulation over markets means that they are leaving free money on the table, for no better reason than because they are afraid to be seen taking it.

This post is somewhat wonkish, but it’s important to set out in detail just why the Conservatives’ stance is so foolish.

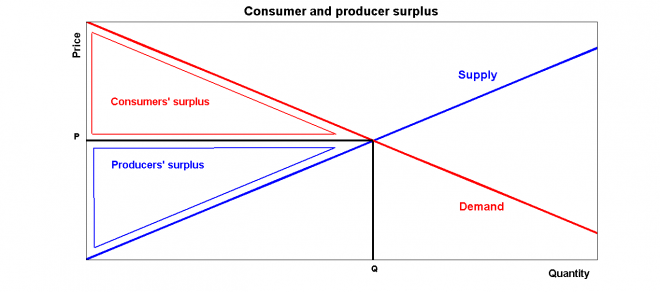

First, some definitions based on the idea of economic surplus:

- Consumer surplus: Demand curves are downward-sloping: the quantity demanded is relatively small when prices are high and increases as prices decrease. But consumers aren’t obliged to pay the maximum price they are willing to pay; they are only required to pay the prevailing market price. The difference between the market price and the amount that consumers were willing to pay is the consumer surplus.

- Producer surplus: This is the counterpart of consumer surplus. Producers who would have been willing to sell at below-market prices benefit from the fact that they can sell at a price higher than their minimum reservation price.

In a standard graph of demand and supply, the market price occurs where the supply and demand curves intersect. Consumer surplus is the region above the market price and below the demand curve: this represents the difference between what some consumers would have been willing to pay and the (lower) market price they are actually required to pay. Similarly, producer surplus—the difference between the minimum price they would have been willing to accept and the (higher) price they actually receive—is the region below the market price and above the supply curve:

The graph above is incomplete if there are externalities, that is, if there are costs (or benefits) that are not attributed either to consumers or producers. If there are negative externalities—pollution is a common example—too much is being produced, and governments should intervene to reduce the quantities produced and sold.

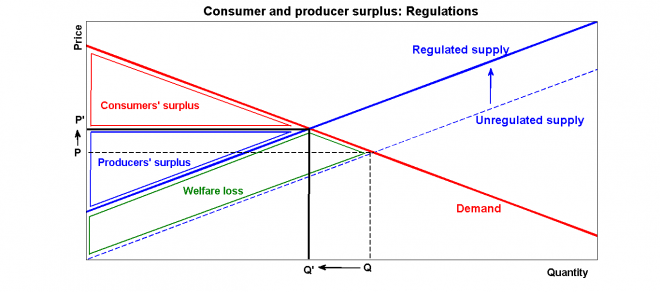

Regulations essentially have the same effect of a technical setback: they oblige suppliers to undertake practices that increase the cost of production. This has the effect of shifting the supply curve up: Faced with higher costs, producers are going to raise the minimum price they’ll accept for any given quantity produced. This upward shift increases prices and reduces quantities produced, which is of course the policy goal. It also affects the producer and consumer surplus:

The increase in prices from P to P’ and the decrease in quantities from Q to Q’ clearly make consumers worse off: the size of the consumer surplus triangle in this graph is smaller than in the graph with no regulations. Part of the lost consumer surplus is transformed into producer surplus: producers benefit from the higher prices. But part of the producers surplus is dissipated by the higher costs of production. (In this graph, it looks as though overall producer surplus has decreased, but it’s possible to change the slopes of the lines and create an example where producer surplus actually increases.)

Regulations decrease total economic surplus—consumer surplus plus producer surplus. The difference between the economic surplus in the first graph and the graph with regulations is the green trapezoid. This reduction in total economic surplus is the deadweight loss: a loss that is not offset by benefits elsewhere. (Except, of course, the benefits that come with reducing quantities from Q to Q’ and thus the associated negative externality.)

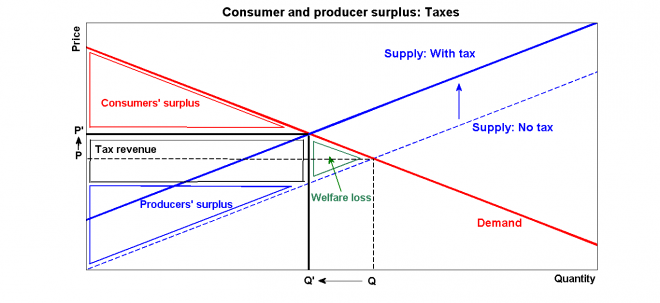

Suppose now that instead of regulations, the government imposes a tax on the sale of the good. This also shifts up the supply curve, as producers will now require prices that offset the extra cost of the tax. The difference here is that government revenues are now introduced into the graph:

The reduction in consumer surplus is the same as in the regulations case; the effects on prices and quantities are the same. And the change in producer surplus is unambiguously negative: producers lose from the lower net-of-tax price and reduced quantities.

The reduction in consumer surplus is the same as in the regulations case; the effects on prices and quantities are the same. And the change in producer surplus is unambiguously negative: producers lose from the lower net-of-tax price and reduced quantities.

There is one important difference, though: some of the lost economic surplus is transformed into tax revenues, the black rectangle whose area is equal to the tax times the quantity sold. There is still some deadweight loss, but the green triangle is clearly smaller than the green trapezoid shown in the regulations case.

There is no way to eliminate all the costs associated from an effective policy for reducing greenhouse gas emissions. The reason why economists overwhelmingly prefer market-based mechanisms is that they reduce these costs to a minimum, and they also provide the government with revenues that can be used to compensate people for those losses and/or to advance other policy goals.

The regulatory approach preferred by the Conservatives is more—not less—costly because it doesn’t generate tax revenues. By refusing to adopt a market-based strategy to deal with climate change, we get the worst of both worlds: all the loss in economic surplus and none of the offsetting public revenue.

(P.S. There’s another important reason why market-based approaches are better than regulations—it will be the subject of my next post.)