tax policy

The slip-up in the Liberals’ biggest policy promise

The details of duelling $6-billion tax pledges from Trudeau and Scheer deserve a closer look, including one not-insignificant omission

The Liberal changes to TFSA contributions were actually historic

In rolling back TFSA contribution limits, the Liberals broke a nearly six decade trend

Why the Mineral Exploration Tax Credit is such a bad idea

With taxpayers worried about government spending, we should demand better than the renewal of a credit that represents a wasteful use of tax revenues

What a child benefit policy can and should do (beyond buying votes)

Let’s not forget that a well-designed child benefits policy can improve well-being, employment, and kids’ lives

Income-splitting isn’t about the rich and the rest

Middle-class benefits make it a different debate

What President Obama’s tax proposals mean for Canada

Expect to see more talk of how tax policy should adjust to the new “Piketty era” of economic inequality

Sorting out who wins with Harper’s family tax package

For families making $180,000-plus, a $1,452 average tax cut

Harper makes his family tax platform harder to tear apart

John Geddes on the politics behind the family tax platform

Note to the NDP (and everyone else): the popular tax hikes don’t increase tax revenues

Stephen Gordon on good politics and not very good economics

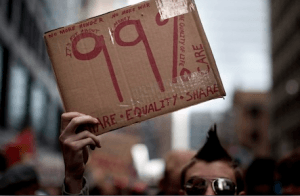

Dealing with inequality, part I: The bottom 99 per cent

Stephen Gordon on why you should love the GST/HST

Republicans divided over Taxpayer Protection Pledge as fiscal cliff looms

‘Zealot’ Grover Norquist continues rally against taxes

Did 2010’s man of the year die in 1897?

Marxism is dead; long live Georgism! With Britain in austerity mode, its government pre-emptively decommissioning aircraft carriers that haven’t been built yet and preparing to bounce a half-million public-sector employees, everybody is looking for policy solutions to make the state’s in-flow exceed its out-go with the least possible agony. That has some progressives, including the Liberal Democrat Business Secretary Vince Cable, looking at the notion of Land Value Taxation (LVT)—applying the new tax burdens not to capital and labour income, which would discourage work and investment, but to the unimproved value of land area, where, to a first approximation, it would merely encourage efficient land use and make it more affordable.