What a rising loonie means for the manufacturing rebound

Manufacturing in Canada has gotten a big boost from the lower dollar, but with the loonie climbing again, should companies be worried?

REUTERS/Fred Thornhill

Share

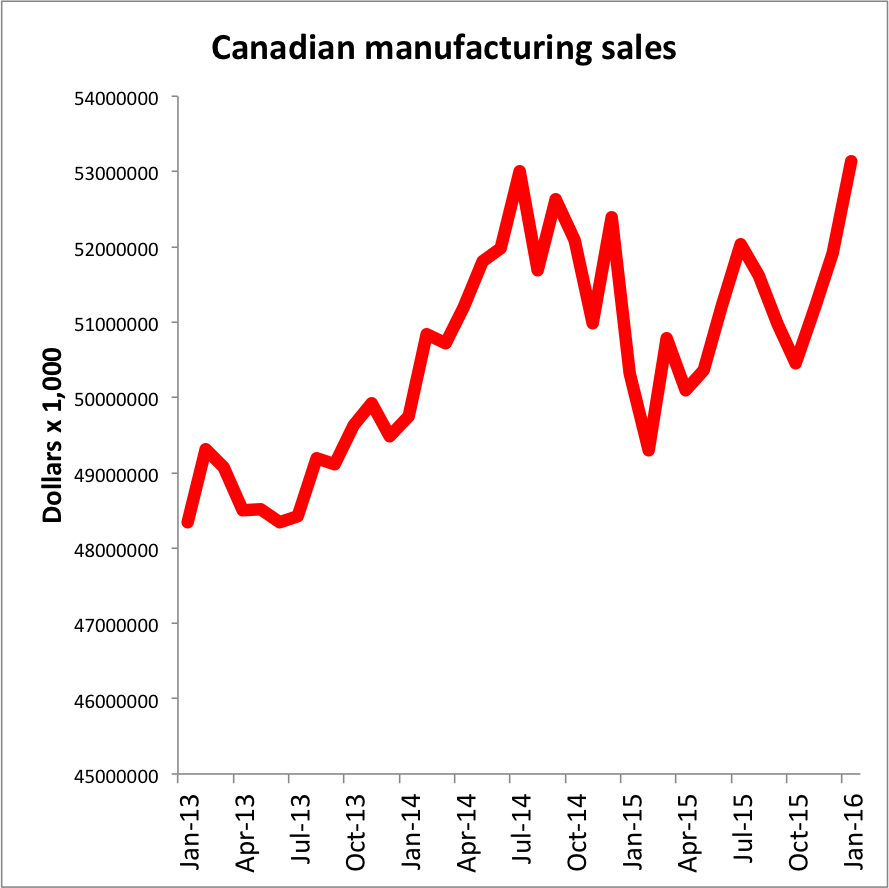

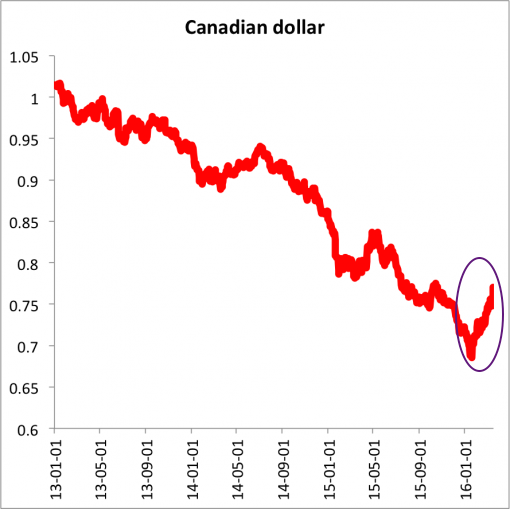

Snowbirds and cauliflower lovers were none too pleased in January when the Canadian dollar fell below US69 cents —a 13-year low—but an important saving grace for the Canadian economy was the boost the low loonie gave to the manufacturing sector. Earlier this month Statistics Canada said manufacturing sales for January hit a record high of $53.1 billion, while new figures show Canada’s economy grew at its fastest pace in three years that month, led by the manufacturing sector. On a month-over-month basis, manufacturing rose 1.9 per cent, faster than any time since 2004.

Since January, however, the loonie has only grown stronger, topping US77 cents this week.

So here’s the question, will this…

… which has immensely benefited from this …

… start to suffer from this?

At the moment, economists aren’t overly concerned with the Canadian dollar’s comeback. At least, not yet.

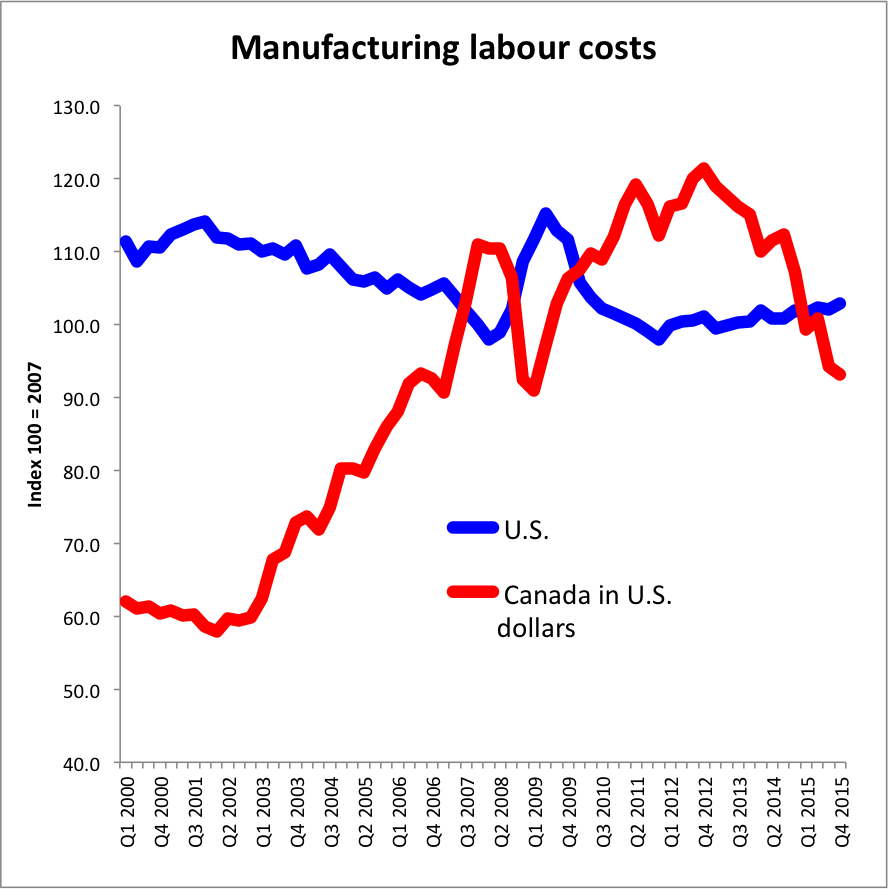

“If [the loonie] went back above 90 cents, it would start to put some of this at risk,” says Mike Moffatt, an economist at Western University. “But relatively speaking, 78 cents is still lower than what we’ve seen over the last 10 years. If you asked manufacturers 10 years ago what they would have thought of a 78-cent dollar, they would have been delighted.”

Just as it took many months for Canada to feel the benefits of the weak dollar, TD Bank economist Brian DePratto says it will similarly take months of steady increases in the loonie before Canadian manufacturers would feel the opposite effect. “A lot of these [sales] contracts aren’t things that change month-to-month.”

Besides, Canadian manufacturers haven’t just benefited from the low loonie but also a robust U.S. recovery. When Americans have more money to buy cars, it is going to aid Canada’s auto sector, regardless of the recent rally.

What manufacturers are likely more concerned about, Moffatt says, is the volatility of the Canadian dollar. From the summer of 2014 to January the loonie had fallen 27 per cent, and has now rebounded by 12 per cent. The currency roller coaster make it difficult for companies when it comes to their long-term planning. “If you know what the dollar is going to be over the next five years, it’s a lot easier to man plants and figure out how much you want to expand.”

Of course, no one knows where the loonie will be five years from now, so all Canadian manufacturers can do is ride the ups and downs—and ups again.